Posted on May 21, 2024 by Yves Smith

Yves here. We are excerpting the opening section of a very important paper by Thomas Ferguson and Servaas Storm. The paper proper explains, in gory detail, how the regular whinging in Democrat-friendly media outlets, about how workers have gotten real wage gains under Biden and are proving their illiteracy via ingratitude, is false. Most workers are markedly worse off in real wage terms. Increases in consumption come substantially and potentially entirely from unprecedented wealth gains at the top of the income spectrum, which has lead them to spend freely despite falls in their real incomes too. Note further these conclusions rely on CPI as the measure of inflation, which many commentators and reader complain understates actual inflation.

The authors finally point out that the top-heavy and wealth-effect driven spending means that Fed interest rate increases would have to rise to a level that would likely kill the economy stone cold dead to beat inflation. We predicted this early on.

So if Trump wins, you will know why. The Democrats relied on their own flattering and superficial metrics to convince themselves that ordinary Americans were doing better under Biden. In fact most became worse off, as many correctly perceive. And they kept flogging the “voters are stoopid” message, adding insult to injury.

Please circulate this paper widely. We are reposting the opening section below, which contains the gist of the argument, and embedding the full document at the end.

By Thomas Ferguson, Research Director at the Institute for New Economic Thinking, Professor Emeritus, University of Massachusetts, Boston; and Servaas Storm, Senior Lecturer of Economics, Delft University of Technology. Originally published at the Institute for New Economic Thinking website

ABSTRACT

The wafer-thin poll margins separating President Joe Biden and Donald Trump have surprised and

baffled many analysts. This paper attempts no analysis of the election itself. It focuses instead on a clinical assessment of its macroeconomic context. Building on previous work, this paper looks first at inflation’s overall effect on real wages and salaries. It then considers claims advanced by Autor, Dube and McGrew (2023) and others about wages of the lowest paid workers. Real wages for most American workers have declined substantially under inflation. We observe no sign of a radical transformation of the U.S. labor market in favor of the lowest-paid workers. The (modest) increase in real hourly wages of the bottom 10% of U.S. workers during 2021-2023 owed little to any policy change or declining monopsony power: It was a unique case of wages rising to subsistence levels as COVID exponentially multiplied risks of working at what had previously been relatively safe jobs at the bottom of the wage distribution. The paper then analyzes inflation’s persistence in the face of substantial increases in interest rates.

We document the wealth gains made by the richest 10% of U.S. households during 2020-2023. These wealth gains, which have no peacetime precedents, enabled the richest American households to step up consumption, even when their real incomes were falling. Empirically plausible estimations of the wealth effect on the consumption of the super-rich show that the wealth effect can account for all of the increase in aggregate consumption spending above its longer-term trend during 2021Q1-2023Q4. Importantly, the lopsided inequality in wealth makes controlling top heavy consumption spending by raising interest rates much harder for the Federal Reserve, without interest rate increases that would bring the rest of the economy to its knees much earlier. We also show that the persistence of inflation in several key service sectors is heavily influenced by captive regulators – a condition that higher interest rates cannot remedy.

Introduction

First, there was COVID. Then came surging inflation, two major shooting wars, food and climate calamities, and an intractable international debt crisis. Now as drones and missiles streak over the real plains of Armageddon almost every day, another apocalyptic event looms on the horizon – a genuine Second Coming: Despite January 6th, major business reverses, and myriads of court cases, prosecutions, and high-profile litigation, Donald Trump is locked in a tight race for the White House with President Joe Biden.

Just when he needed money the most, a stunning feat of financial engineering vaulted him back into the ranks of the American super-rich (Moore, 2024). Though some major business groups remain aloof (Goldmacher and Haberman, 2024), many billionaires who swore off ever supporting him again are flocking back to his standard, while companies that loudly proclaimed their determination to cut off campaign contributions to Republican legislators who supported the January 6th effort are pouring funds into the coffers of both the legislators and Trump’s campaign (Gold, 2024).1 With a vast network of lavishly funded think tanks drawing up blueprints for drastically revamping government in the event Trump wins, Democratic leaders are plainly distressed (Arnsdorf, et. al., 2023). Already mired in a blazing civil war over policy toward the Middle East, they are now weighing their responses to the United Autoworkers (UAW) electrifying success in organizing the Volkswagen plant in Chattanooga, Tennessee and the wave of unionization efforts its success is engendering as inflation stays stubbornly high.

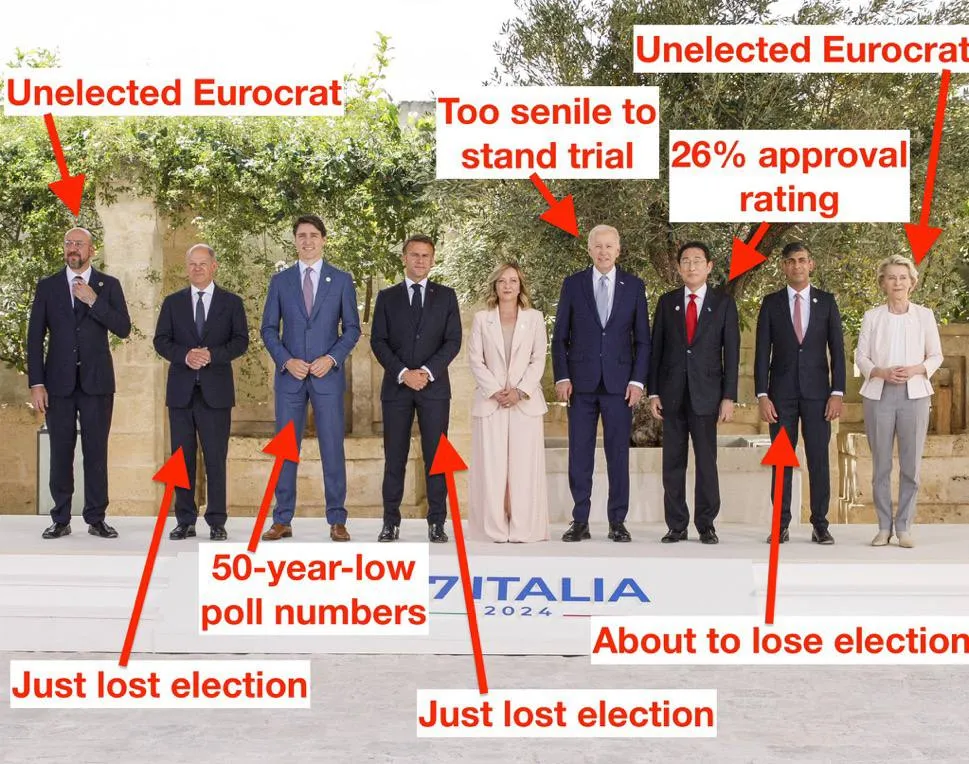

The wafer-thin poll margin baffles establishment news and political analysts (Wallace Wells 2024; Krugman, 2024a). Wringing their hands in exasperation, they point to macroeconomic indicators indicating that the U.S. economy is humming along. Powering out of the COVID19 recession of 2020, the economy is growing at more than 3% (on an annual basis) in the first quarter of 2024. The official unemployment rate of 3.8% in March 2024 hovers near a fifty-year low; real earnings of U.S. workers have been rising for some months; and consumer price inflation has dropped from 8.6% in the second quarter of 2022 to 3.2% in the first quarter of 2024. The economy’s ability to defy widespread predictions of recession in the face of Federal Reserve monetary tightening had even fed hopes for a “soft landing” that could open the way for another round of interest rate cuts that could spur financial markets to new records – at least before the Chattanooga vote.

Many observers also extol the President’s landmark policy achievements: Not simply the vast aid programs for ordinary Americans that his administration launched as it came to power, but the series of dramatic industrial policy initiatives that startled the rest of the world. These include the Inflation Reduction Act (IRA), which set in motion far-reaching transformative programs of loans, grants, and tax credits to adapt the US to the realities of climate change; the Chips Act, which incentivizes industries to reshore production in strategically important industries; and a separate infrastructure package worth more than a trillion dollars over time. Not to mention the other steps the administration took on behalf of racial justice, student debt relief, unions, and consumer protection.

The perplexity runs so deep that a cottage industry has sprung up generating ingenious explanations of why the election is so close. Their common core is the invocation of clear forms of irrationality – individual and social cognitive failures, mass amnesia about Trump’s actual record, or, inevitably, disinformation spread by any number of bad actors at home or abroad (Glasser, 2024; Krugman, 2024b).2

We view this situation as a trap, especially in the light of the UAW’s stirring victory and mushrooming campus protests. A year ago, as the Fed responded to inflation by abandoning its policy of quantitative easing – ultra low interest rates – and started rapidly raising them, we argued that the economic situation of most Americans was far more tenuous than commonly recognized (Ferguson and Storm 2023a). We contended that relying on central banks and fiscal policy tightening to contain the historically specific form of inflation raging through the economy would not work out well.

It was simply untrue, as Lawrence Summers and many other mainstream economists contended, that the inflation resulted from a US-specific wage/price spiral, set in motion by the President’s stimulus program. The time paths of inflation and the stimulus spending did not at all align; and, decisively, wages clearly lagged well behind prices. Since our paper, evidence against this view has continued piling up and we are not surprised that at a recent Brooking conference no one at all defended the position.

In fact, the inflation was worldwide and shocks to supplies were clearly its primary cause, though of course profit-maximizing firms took advantage of the fear and uncertainty to raise profit margins when they could (“profit inflation”).3

The most immediately disruptive of these supply shocks came from COVID – full stop. But other forces compounded the desperate situation. We pointed to accelerating climate change, with its dramatic effects on storm damages, floods, droughts, temperatures, and food prices, and an increasingly belligerent multipolar world economy that was redefining risks for value chains and national security.

The customary response of central banks to inflation – raising interest rates – would do little to resolve any of the underlying problems. COVID and its supply chain snarls required active large- scale government interventions to increase supplies, reduce bottlenecks, and protect public health. In practical terms, that made inevitable a new round of massive borrowing by governments.

Neither would raising interest rates palliate supply problems. They were certain to discourage investments in climate change mitigation, given that many of the most promising forms of renewable energy require major upfront investments to scale up efficiently. Many renewables also return steady, but not flashy streams of revenue, so that higher interest rates could reduce their appeal to financial markets demanding rates of return at levels comparable to those of, for example, private equity. But slow walking efforts to counter climate change would guarantee further future rounds of price shocks and other adaptation costs as the climate worsened. Higher rates would also inhibit adjustments in value chains and production shifts required for resiliency and enhanced national security amid radically shifting international alliances and conflict threats.

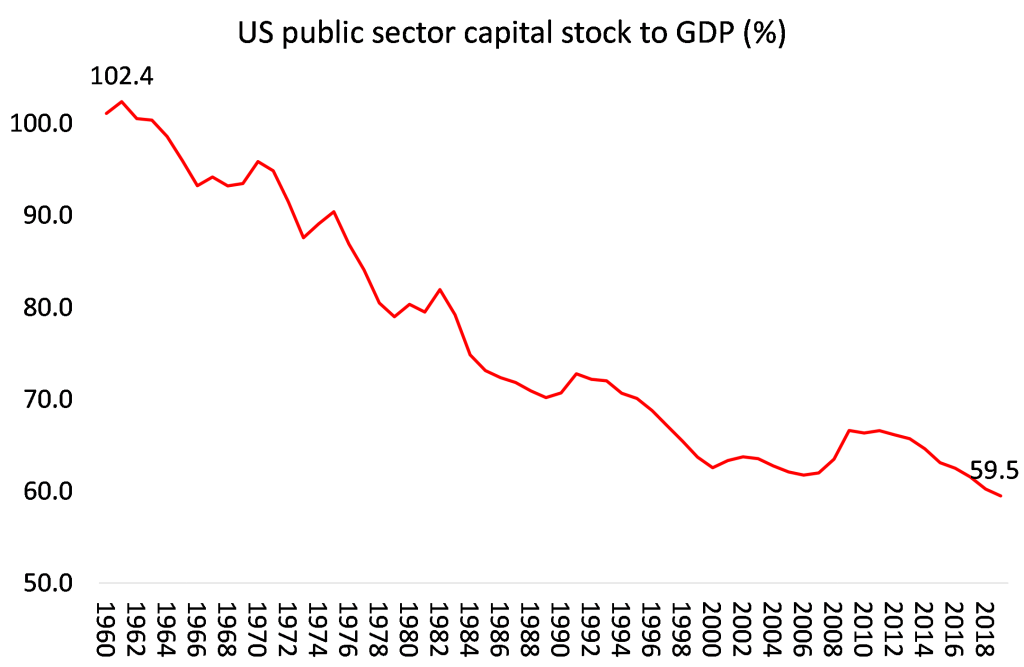

We especially emphasized the potentially fatal implications for controlling spending via interest rates from the dramatic change in the wealth holdings of American’s most affluent citizens. These swelled as a consequence of the Fed’s latest round of quantitative easing after COVID hit. As the central bank’s ultra-low interest rate policy levitated financial markets, wealth concentration quite exceeded levels reached earlier. Most gains went to the rich and super-rich. As COVID eased off in 2022 after vaccines were introduced, spending by the wealthy exploded, even as ordinary Americans struggled as the temporary government programs ran out. The increase in spending out of wealth, we estimated, was roughly the size of the entire Biden stimulus program. Coming online just as total government spending nosedived, it massively increased demands by the affluent for goods in short supply. In the inflation debate, this was the missing elephant in the room.

Our paper contended that upward shifts in wealth of this magnitude – which had no peacetime precedents – were producing dramatic shifts from quantity to quality in the structure of the economy. In the short run, the lopsided inequality in wealth would make controlling consumption spending by raising interest rates much more difficult. Consumption by the affluent would be far harder to slow, without interest rate increases that would bring the rest of the economy to its knees much earlier. The shift in wealth would also fuel illusions that high volumes of aggregate spending were reliable indicators of broad social welfare.

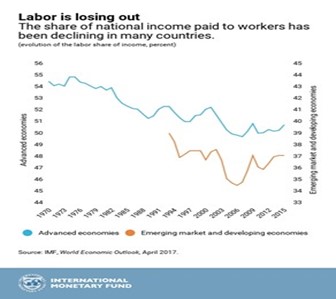

Which they were anything but. We showed that claims of broad wage gains under Bidenomics were specious. The opposite, in fact, was the rule: The U.S. was plainly in the throes not of a wage-price spiral but a price-wage merry go round, with real wages for most workers falling steadily behind prices. For one set of workers only this pattern did not hold true: workers at the very bottom of the wage distribution were indeed seeing pay raises in real terms. This owed little to any policy change: It was a unique case of wages rising to subsistence levels as COVID exponentially multiplied risks of working at what had previously been relatively safe jobs and workers at the bottom of the wage distribution left their jobs.

The increasing economic heft of the superrich exercised a magnetic attraction on the American economic structure, transforming parts of it quickly. In many instances, the result was plainly socially irrational: jobs in high-end restaurants were flourishing, while low-paid work in nursing homes, childcare, or education dried up. Long-COVID and related health problems continued to disorganize labor markets, leading many workers to withdraw in whole or in part from them and confusing analysts who judged according to older rules of thumb.

A year later, some of the points we made, especially concerning climate change, have been taken up, if not exactly taken to heart (Ferguson and Storm, 2023b). But the central parts of our macroeconomic message mostly have not, though recently some bank analysts and media accounts

have begun to recognize the importance of the wealth effect that we pointed out already in January 2023 (Rugaber, 2024). But the issues of wealth effects and real wages, unfortunately, are crucial for understanding why an incumbent president presiding over a growing economy is scrambling to hold on. Or why, five years after COVID and four years after a Democratic President who pledged to be the most pro-union president in American history, the prospect of a real wage/price spiral (or “Kaleckian Moment”)4 might at last be a real possibility as the presidential race heads into its home stretch.

This paper is not directly a venture in election analysis. That would require attention to many issues we have no space for here, such as foreign policy, abortion, or immigration and border issues. We have a sinking feeling that the outcome of the 2024 election may now be in the lap of the gods – or, as statisticians might say, some Poisson distribution. With age an issue for both candidates, a public stumble by either could tip the outcome. So could any number of foreign policy surprises, including the course of several wars. OPEC+ is clearly trying to raise oil prices, which will certainly affect inflation. Whatever happens, Federal Reserve policy will surely be important. If the Fed responds, as so often in American history, to a belated wave of efforts by workers to catch up with inflation by tightening policy or holding rates up too long, it could indeed shorten the odds of a Second Coming.

Instead, this study is one of several papers that we are writing to illuminate the real macroeconomics of the Second Coming, which we emphasize that we do not consider inevitable. Our hope in this one is to explain how the macroeconomic problems in our earlier paper have blinded many participants and observers to the actual state of the American economy as the election approaches.

The current paper returns to the key questions of wages and incomes and how wealth effects cripple reliance on interest rates to control inflation. British studies (e.g., Alexandri et al. 2024), have drawn attention to COVID’s continuing impact and related medical issues on labor markets. In the United States, comparable discussions can be found only in specialized, public health-oriented circles. Most of the press, both political parties, the Biden administration, and the Fed, emphasize how well labor markets have rebounded. The importance of recent work identifying biomarkers associated with Long COVID or the ramifying hazards of reinfection (Alvelda, 2024; (Strulik and Grossman, 2024) has yet to be broadly recognized. We believe COVID and related public health problems continue to roil labor markets; the epidemic is not over, though its effects have become more subtle and complex. The present study treats COVID only as much as necessary to understand debates about low wages; we leave its broader effects on labor markets for a subsequent paper.

Our exposition divides, like Caesar’s Gaul, into three parts. Part I analyzes the course of wages. It begins by surveying economy-wide evidence. The conclusion is inescapable that real wages for most Americans have dropped substantially during the Biden presidency. The cumulative losses for most are substantial. We then consider in more detail claims advanced by Autor, Dube and McGrew (2023) and others about wages of the lowest paid workers. Stressing the rebound in labor markets since COVID, they argue that these workers, at least, have enjoyed substantial gains – characterized at times as “unprecedented in a generation.” They also argue that differences between the highest and lowest wage levels have compressed significantly, concluding that “disproportionate wage growth at the bottom of the distribution […] reversed almost 40% of the rise in 90-10 log wage inequality since 1980, as measured by the 90-10 ratio” (Autor et al. 2023, pp. 33-34).

These claims were not correct when they were put forward and they remain wide of the mark now. They draw mostly on evidence from hourly wage data, which have severe limitations. We will show that most gains by the lowest paid workers occurred in a few months in 2020. They largely

reflect, as we argued before, rising premia for safety when low paid, but safe, jobs suddenly became low paid and deadly once COVID hit. Most definitely these wage gains do not reflect sudden changes in monopsony – the local domination of labor markets by one or a few employers.

We buttress our conclusions by tracing how fitfully data for personal income, life expectancy and median household incomes have rebounded from their disastrous nadirs at the height of COVID. We are thus not surprised by the new wave of unionization efforts, though their success is hardly guaranteed.

Part II of our paper looks again at the evidence about wealth effects. Despite the sharp rises in interest rates, stock markets have surged again. The latest climb arguably reflects hopes for early interest rate cuts (now mostly dashed) but also the advent of epoch-making technological advancements. Whatever its causes, the surge has brought the wealth of affluent Americans back to record levels. And just as they did after Omicron waned, affluent Americans are again spending at prodigious levels. As before, interest rate checks on their consumption are feeble.

Our Conclusion shows how continuing demand, (mostly) by the affluent for services whose

production conditions are controlled by captive public regulators, helps fuel inflation in the service sector. Raising interest rates to control inflation in such cases is pointless; policy has to address the underlying problem, not squeeze the rest of the economy to no end.

_____

1 Partial inventories of major companies that promised not to fund election deniers are widely available on the internet. See, e.g., Piper and Montallero (2023). Fundraising for 2024 is massive and reporting lags behind the reality. We have checked enough to support our paper’s claims here.

2 It is not news that partisans of each party tend to misperceive the state of the economy. The 2024 case quite clearly goes well beyond such effects. It obviously affects many Democrats, for example. The obvious insufficiency of this chestnut inspires the present flood of ruminations.

3The literature is vast, but see Storm (2023); the question cannot be reduced to simple mark-up maintenance. Note that with so much inflation coming from the supply side, profit inflation can hardly drive the entire process. In this respect, a recent paper by the San Francisco Fed (Leduc, Li, and Liu, 2024) creates something of a straw man. They do not show detailed data, but it is interesting that “salient industries” show clear evidence that markup rose over time and that over the entire economy, their lowest estimate remains in positive territory, unlike the other recoveries they plot.

4 See, e.g., Ratner and Sim (2022), but also the acute critique in Seccareccia and Romero (2022).

(The entire paper(105pp) can be viewed at link.)

https://www.nakedcapitalism.com/2024/05 ... biden.html

******

Yellen’s visit to Beijing: penny lectures from economic ignoramuses

The USA is outraged to find it no longer calls all the shots on its much-promoted world market.

It turns out that the imperialists are only in favour of a free market if that ‘freedom’ is rigged in their favour. The sight of the USA of all countries complaining about ’unfair competition’ has all the absurdity of a Monthy Python sketch.

Proletarian writers

Monday 20 May 2024

With the USA’s national debt topping an eye-watering $31tn, inflation running rampant and the accelerating deindustrialisation of the economy, treasury secretary Janet Yellen clearly has her work cut out.

But instead of facing up to the reality of the situation at home, Yellen used the occasion of her week-long April visit to Beijing to lecture her hosts on how best to run their economy.

Through the tunnel vision of her unipolar lens, Yellen could plainly see that the origin of all the USA’s woes lay in the unreasonable insistence of China on her right to continue the dynamic industrial expansion that has raised so many millions of Chinese citizens from poverty and looks set fair to help the independent development of many more millions globally via the Belt and Road initiative and other partnerships.

Yellen’s real complaint about China is that it is “simply too large”. “The Treasury has called on China to stop over-subsidising [!] its green-tech industry — a situation that US officials say risks [!] flooding global markets with cheap solar panels, electric vehicles and lithium-ion batteries. ‘China is now simply too large for the rest of the world to absorb this enormous capacity.’” (Janet Yellen says US-China relations on ‘stronger footing’ by Claire Jones and Joe Leahy, Financial Times, 8 April 2024)

Whatever happened to saving the world with green industries and products? Surely the ecowarriors in the White House should be dancing a jig to see that economies of scale in China are rapidly bringing down the costs of solar panels and electric cars?

But apparently solar panels and electric cars only save the world if they bring profits to western corporations!

While the USA belly-aches about the effects of a giant global powerhouse on its remaining industrial base, we can’t help remembering that no such qualms bothered Washington when it was the American colossus that bestrode the world.

But with the balance of forces in the world shifting fast, it seems that those who only yesterday were the most zealous evangelists of capitalism have to be reminded of the basic tenets of their beloved ‘free market’.

“Supply and demand balance is relative, with imbalance often being the norm,” Chinese vice-finance minister Liao Min said on Monday, dismissing Yellen’s concerns. “This can occur in any economy operating under a market economy system, including historical instances in the US and other western countries.”

Meanwhile, Chinese commerce minister Wang Wentao pointed out: “The country’s renewable energy and EV industries were not the product of subsidies but the outcome of innovation and market competition.” (How Janet Yellen struggled to move the needle on US-China trade by Claire Jones and Joe Leahy, Financial Times, 10 April 2024)

These hard economic realities will be evaded neither by diplomatic soft-soap nor by ramping up economic aggression (as, for example, the 25 percent levy imposed by the USA on cars and parts imported directly from China).

The plain truth is that the USA has been spending far beyond its means for decades – an unsustainable and ultimately catastrophic model that the Chinese government politely refuses to follow.

While the USA was living on borrowed money, amassing unserviceable debt and printing new dollars on a vast scale to try to escape a looming economic crash, its money-printing had the effect of exporting inflation around the globe, thus forcing the rest of the world to pay the price for US impecunity.

Now US monopolies are livid that Chinese industry is out-competing them, foiling hopes that they might somehow export their way out of the deep economic crisis in which they find themselves.

The problem of overcapacity is central to capitalist commodity production and will only end when that system is replaced with socialist planning. Pending that happy outcome, let Yellen and company save their unsolicited advice on how China should run its economy!

https://thecommunists.org/2024/05/20/ne ... economics/