Historicizing Inflation and Price Controls with Andrew Elrod

Posted Feb 02, 2022 by Maxximilian Seijo

Transcript

The following was transcribed by Richard Farrell and has been lightly edited for clarity.

Maxximilian Seijo: Andrew Elrod, welcome to Money on the Left.

Andrew Elrod: Hi, great to be here.

Maxximilian Seijo: So for our listeners who probably don’t know that much about you yet, could you spare a moment to talk a little bit about your personal and professional background?

Andrew Elrod: For sure. I was a teaching assistant and graduate student in the Department of History at UC Santa Barbara for six years. I just finished this summer and filed a dissertation on the history of wage and price controls in the United States from World War II to The Volcker Shock, so sort of in the middle half of the 20th century. I do some public writing related to that, but I’ve also recently taken up a position in the research department of a labor union in Los Angeles–the city where I live–so I’m kind of in a moment of transition. But I like to think there’s a thread keeping my interests between the two jobs together.

Maxximilian Seijo: Cool. For listeners who might know where I am institutionally, you’ll notice that Andrew and I did or are doing our PhDs at the same institution. So there are some heterodox spaces around, perhaps, where you don’t expect them to be. Part of the reason why we wanted to bring you on the show, and why we wanted to have this conversation via Money on the Left, is that inflation and prices are all themes and buzzwords that are really present for us today. We live in an era of 7% CPI measured inflation. We can problematize that measure if we want to, but in relation to this, you recently published a piece with Equitable Growth titled, “Austerity policies in the United States caused ‘stagflation’ in the 1970s and would do so again today.” To begin unpacking this piece, why don’t you start by discussing what the conventional wisdom for dealing with inflation, or this so-called economic problem, is today. Mainly, maybe you can touch on some themes of excess demand, or the demand driven story about inflation. What is it? Who is espousing this story and why? Why do most mainstream economists believe that to be the narrative?

Andrew Elrod: Sure. Well, just to begin with, you opened by saying we’re in an era of 7% inflation–it’s only been a year. Between 1968 and 1979 or so, the annual inflation rate was up between 5 and 12%. That’s twelve years. And that’s remembered as a bad time in history, but we’ve yet to see exactly what’s going to happen today. We are about a year into a new inflationary environment, but whether it’s going to be an era, I think, is kind of open at the moment. But, of course, that’s why it’s in the news. Everybody’s afraid of that. So to answer your question about the conventional wisdom, so to speak, around macroeconomic management, the historical answer is that, since the Depression, but especially since World War II, global economic thought has centered around the ideas that came to be associated with John Maynard Keynes–that there is such a thing as a full employment level of spending, or a full employment level of demand, and that that demand can be manipulated by national governments. This is the set of underlying assumptions that the whole macroeconomics discipline was founded on.

Before the 30s and 40s, there was no such thing as macroeconomics. There was classical political economy. There was a neoclassical school at the end of the 19th century, but macroeconomics is really a 20th century development. And it’s related to a variety of things, including the Depression itself. The intellectual problem of how societies could pull themselves out of the Great Depression was certainly one impetus. Then, there are also developments in statistics. I think Adam Tooze is probably one of the best examples of a historian who’s shown that the concepts themselves, such as the level of demand, depend on governments setting up accounting systems to measure things ‘out there,’ like expenditures by households and firms, and integrating them into a comprehensive system of accounts that you can use as an instrument for doing things that we now call macroeconomic analysis. So the conventional wisdom is a simplified Keynesianism, or what some people might have once called, ‘bastard Keynesianism,’ which holds that raising or lowering the level of demand in a national economy depends on fiscal and monetary policy.

The division between those two things is itself, I argue, a historically specific development, particularly in the United States during the time of McCarthy. But the idea is that the level of spending, the amount of money people have to realize their wants, is something that the government can control through taxes and its own budget, or taxing and spending, which is fiscal policy. The credit system, or central bank policies–often, for much of the 20th century, regulations over how much the private member banks under the government’s central bank, or who have to borrow from the government’s central bank, regulations about what they can do, what they can lend, how much they can lend, for what purposes they can lend, that credit realm is the other traditional instrument–is monetary policy.

So today, a lot of the debate departs from the point of view that there’s too much demand, or people have too much money in their pockets and businesses are investing too much. This is a problem because prices are rising. Demand is above supply causing prices to rise. And the solution to this problem of wanting prices to stop rising is to take money out of people’s pockets to reduce demand, either through reducing spending, and you see this very heavily in an opportunistic and kind of right wing ideological way around the expanded Coronavirus emergency relief measures, like the enhanced unemployment benefits. Joe Manchin, for example, as a Democrat does this and gets in front of the Senate and says social spending is causing inflation, or giving low income, working class people money is causing them to spend more than the American economy is capable of supplying them. That’s causing prices to go up so we can’t have any more of that. And that would be a fiscal contraction.

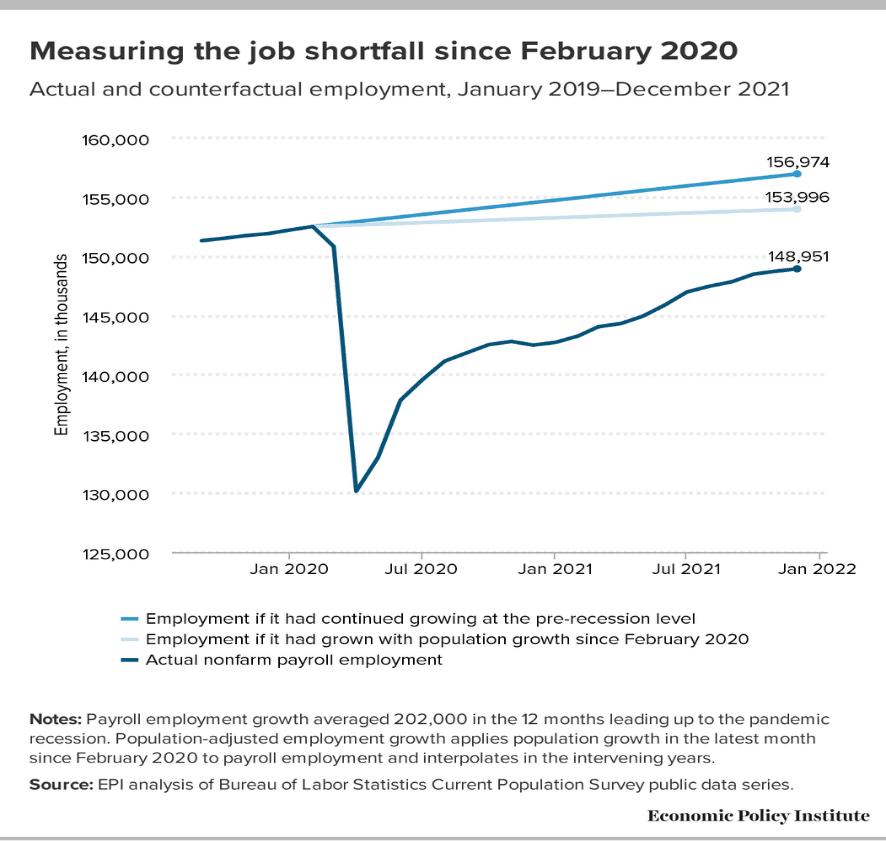

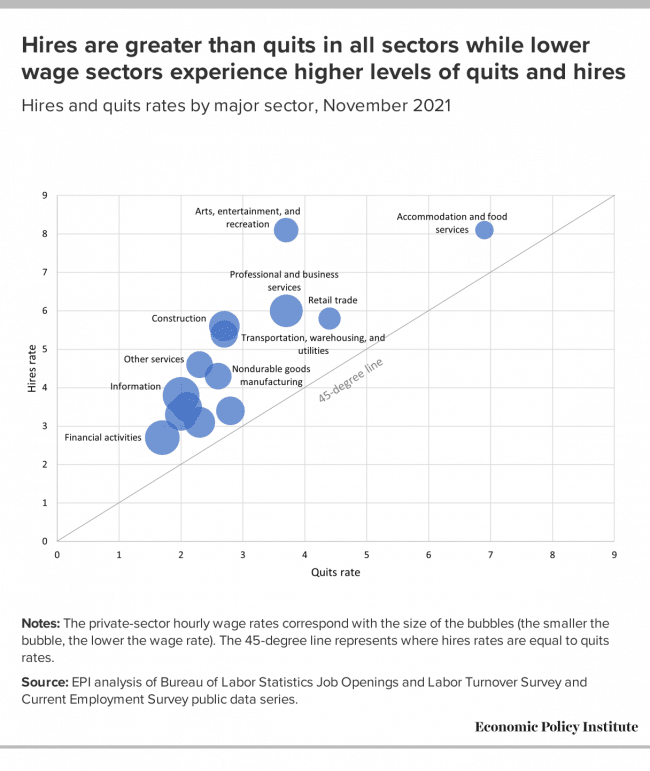

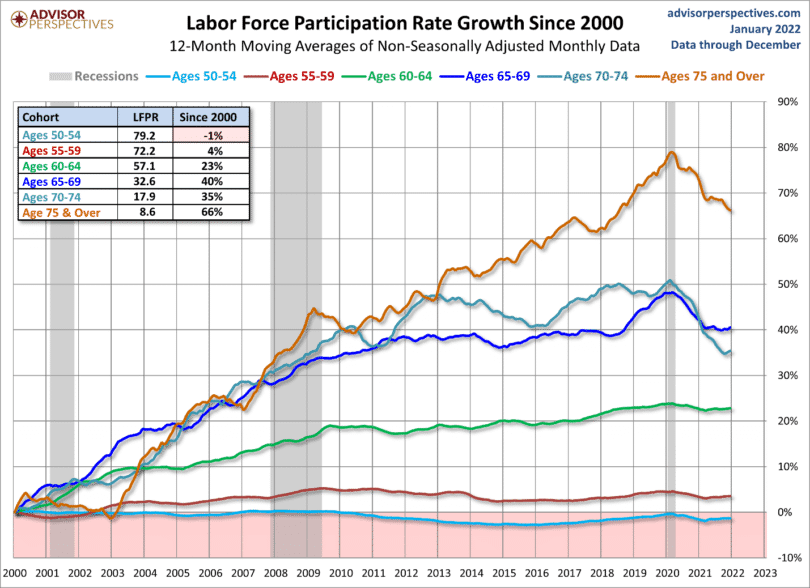

Interestingly enough, no one is talking today about raising taxes, although that would also be a kind of orthodox fiscal contraction, or anti-inflationary, tool. But then, the other thing that’s really in the news, and in part because it doesn’t rely on Congress, is contractionary monetary policy with the intention of restricting demand. The idea there is that, if you can raise interest rates, then investors are going to, well, first of all, borrow less to make real investments. There’s going to be fewer apartment buildings going up, fewer new warehouses going up, and the cost of credit, which is a crucial component of running a business, is going to go up. So you can slow investment down that way. And the understated, or sometimes unstated, but universally acknowledged, effect of that is to increase unemployment. So part of the reason that I think that writers say there’s such a controversy right now over the idea of the Federal Reserve raising interest rates, is because the effect is going to be to throw people out of work. And there’s still a lot of people who don’t have jobs. So that’s kind of a survey of the inflation dilemma right now as I’m sure you and your listeners know.

Maxximilian Seijo: In what you’re describing, perhaps we could boil it down into a phrase of the economy ‘overheating,’ right, in that conceptual sense. I think you do a great job of looking backward towards the intellectual and conceptual dynamics that produce the composite environment for coming to that conclusion. As you say in your piece that I referenced with the last question, this conventional narrative is itself preoccupied with a subset of an era, of the time in which you describe macroeconomic economics as coming into fruition or to the fore, which is the 1970s. So as we investigate this conventional wisdom, can you tell us a little bit about what the policy debates of the 1970s were, and particularly, as they related to things like inflation or pricing? On the way, the listeners, I think, would enjoy hearing a little bit about the Marilyn Monroe lyric that references JFK’s particular pricing management schemes?

Andrew Elrod: Yeah, the 1970s are a very interesting time, and really, I think, the time when what we think of today as the popular handbook for how to handle inflation was written, because there was a big twelve year debate about what to do. Before 1979, there was a much more sophisticated understanding of what caused prices to rise, or more generally, price determination. It had grown out of the 1920s, sort of the pre-macro era, when price theory itself was not monopolized by ideologues, but instead was an open subfield where growth of the large vertically integrated manufacturing corporation, branded products, and a world in which price competition appeared increasingly to be vanishing from consumer life had to be reckoned with. So there’s this intellectual tradition that dates back to before the war, but it survives after the war. In the mainstream of economic thought, and certainly applied economic thought, where the administrators and politicians’ staff who make the laws that govern the economy and enforce them within that mainstream occupy, there was an understanding that prices in particular markets rose for particular reasons.

There was the very recent memory of World War II, and again during the Korean War, of economy-wide wage and price controls and periods of emergency when Congress granted the president the powers to impose ceilings, dollars and cents ceilings, on particular commodities. Also, surviving after the Korean War, was a knowledge of the government itself as an actor in the marketplace, a large procurer, a huge customer, and a customer whose own purchasing decisions could have an effect in shaping markets. So this is the world in which John F. Kennedy is elected, assassinated, LBJ takes over, and then the Vietnam war happens. This is the world that we think of as the 1970s beginning. So by the time you get to the middle of the 1960s, the beginning of the escalation of the US occupation of South Vietnam, and the bombings of the Vietnam War, there is a fairly elaborate and sophisticated understanding of how to manage the economy. It’s very different from today where salaried pundits will write about the importance of reducing demand and the worries of an ‘overheating’ economy. That phrase itself ‘overheating’ became popularized during the Vietnam War.

Now, just to answer your specific question about Marilyn Monroe, John F. Kennedy, and everything else, the Kennedy administration enters office during a recession. There is a long recessionary period. Technically, it’s two business cycles, from 1957 to 1961, in which the major employment centers have hundreds of thousands of unemployed workers. The auto industry in Detroit in the late 1950s was a hard place, because if you’re an auto worker, you can’t get enough work for the whole year. There was a sustained stagnation in American manufacturing at the end of the 1950s. So this is the environment in which John F. Kennedy runs his notable campaign slogan, “Get America Moving Again.” So he runs on this program of growth. We’re gonna grow the American economy, we’re going to put people to work, we’re going to build factories, we’re going to build houses, and we’re gonna build missiles–it’s a high Cold War period. But the problem with that is that, during both the World War II mobilization, the great thing that finally pulled the country out of the Depression, and during the Korean War, which was itself also a massive expansion of industrial capacity, there had been inflation.

So Kennedy comes into office with this problem of promising growth, but not wanting to cause inflation to happen. The solution that his advisors come to is what are called wage and price guidelines, which is a loose set of non-binding, voluntary guidelines for companies and workers, particularly labor unions, to use in negotiating wages and prices. For the biggest companies, they don’t have to negotiate with anyone; they just set their prices. But it was a set of guidelines for corporate managers and union leaders to consult in making the decisions that govern economic life. So the administration finds itself in a strange, hostile environment with big business, because voluntary price guidelines, as much as the administration had bent over backwards to warn everyone that they’re not going to assuage fears, that they’re not going to impose price controls–they have voluntary guidelines–as much as they do that, the organized businesses in America and the business press says this is de facto price controls. Kennedy is a crypto-communist. Only loony people would say that back then, but the reaction was very hostile.

In fact, by 1962, US steel, which had been the biggest corporation in America, made a point of publicly violating the price guidelines. The company had been meeting with the White House regularly. There had been big labor negotiations in 1961. Labor negotiations are traditionally a time for large employers to raise prices so they can have precautionary funds to pay any wage increase they’re forced to pay. Throughout this period, Roger Blough, the chairman of US Steel, had never indicated that he was going to violate the price guidelines. But in the spring of 1962, after labor negotiations were done, he came to the White House with a memo that said, “These are our new price schedules.” And it’s immediately clear what’s going on for the JFK administration. The President explodes and then there’s an emergency weekend, a three-four day emergency where the Department of Defense and the President’s advisors hold these press conferences saying this is un-American and unpatriotic.

There is a famous anecdote, which if you read any history of the Kennedy administration, this is when the President says, “My father always told me that all businessmen are sons of bitches.” That’s actually printed in Fortune or one of the business magazines. The result is that US Steel rescinds the price increase. They enforce the guidelines. It’s very difficult because they can’t just go to the court. It’s not a law. But what they do is they say they’ll issue a preferred contract, a procurement contract, for steel products at a lower price. I think Kaiser steel, the West Coast steel company, takes it and now business is going on at the lower price. And US Steel, if they don’t want to lose market share, then they’re going to have to meet that. So they rescind the price increase and that becomes a legendary moment of the early Kennedy administration. And it sets up the later 1960s in a really interesting way, where you can see why businessmen, especially anti-communist businessmen, themselves come to oppose Johnson and see the Democratic Party, which had been their instrument, as somehow betraying them. It sets up the greater rightward shift in American political culture.

But, because that was such a high profile scandal, at Kennedy’s birthday in May, they have, famously, Marilyn Monroe come out on stage and do a number in a sequined dress. And it’s very glamorous, but the lyrics to the song she sings are…

Marilyn Monroe:

Happy birthday to you,

Happy birthday to you,

Happy birthday, Mr. President,

Happy birthday to you.

Thank you, Mr. President,

For all the things you’ve done,

The battles that you’ve won,

The way you deal with US Steel,

And our problems by the ton.

We thank you so much.

Andrew Elrod: “Happy Birthday, Mr. President, for all the things you’ve done, the battles that you’ve won, the way you deal with US Steel, and our problems by the ton. We thank you so much.” What is that about? It’s about the fact that the President was willing to call one of the biggest businessmen in the country to the White House and denounce him for profiteering. And that was celebrated. Everybody remembers Marilyn Monroe’s “Happy Birthday, Mr. President,” but nobody remembers what it’s about. So that’s that anecdote.

Maxximilian Seijo: Yeah, that’s such a fascinating story. It makes me think of so many different things and how it reverberates into what we can think about as politically possible relation to pricing in general. Maybe we can come back to that, but I want to start to dig in a little bit. Coming out of that particular moment, there’s a shift in the way that pricing is dealt with. So in your piece, you argue that, throughout this history, the shift to austerity as opposed to these wage price guidelines, perhaps as a microcosm of a larger shift with more complex variables, was not only right wing or reactionary, but was actually not helpful for combating price increases. You even say that this austerity exacerbated the inflationary pressures in a complicated way with this change in price management policy. So could you explain how those dynamics work themselves out?

Andrew Elrod: Yeah, I mean, one fact that we all have to acknowledge is that there are centers of concentrated power in many markets. Not every market, but there are companies, and many writers argue all companies do this, who set their prices after making certain decisions about the preferred rate of return they want, the target profits, the expected volume of sales, all things that that may or may not happen, and that prices are then administered after the fact. So you end up selling and making as much as the market will take at whatever price you set, but you’re setting the price. That analytic distinction in business management is something that many models of price determination do not take into account. They assume that everyone is always receiving a price, that businesses will always be adjusting their prices in real time, but many large companies post their prices at the beginning of the year, and then they post them again when they change them next year. So that’s the starting point for thinking about it.

Now, what’s going on in the 1960s is an intense battle between organized labor and the core industries, including construction. Construction is a little different in that each city will have its big construction firms. One big trend in the business history of the 1970s is the growth of these national construction companies. There is a battle between organized labor, which these unions had been built up maybe a generation before in the Depression, during World War II, and had gone through maybe four or five contract cycles during the 1950s. By now they have a seasoned leadership who know what collective bargaining is and they understand what the real purchasing power of the wages they win are. You have this union leadership now confronting a corporate sector that can raise prices on its own, because of the growth financed by the Vietnam War. So you have an inflationary environment in which companies are raising prices because they can and because unions are then raising wages and forcing up costs.

This is what had been known as a wage-price spiral. In the 1940s, there was a lot of writing about how we arrest the wage-price spiral and how we interrupt the wage-price spiral. And people still use that language, but by the end of the 1960s, that’s what the guidelines were intended to do. If you say the guideline is a 3% increase, then you can’t bargain for a 7% wage increase, because that’s outside of the guidelines. Between 1960 and 1966, the biggest unions of organized labor all adhered to the guidelines out of a sort of political loyalty to the reform project of the Kennedy administration and the Great Society. There had been a sort of political coalition. But by the end of the 1960s, once you do get 3-4% inflation, the guidelines don’t work on labor, for one, and they had never really worked effectively on business, beginning in 1966-67.

So Nixon gets into office in 1969 having campaigned on repealing the guidelines. And that’s a situation where things really decisively change, because during 1969 and 1970, you take the guidelines off and the inflation that had been around 4% in 1968 goes up to 5-6% by 1970. So what we think of today as stagflation is really something that comes into consciousness, or sort of crystallizes, for journalists in 1969-1970. Now, there’s two other parts to this that you should understand, which relate to conventional macroeconomics, or fiscal monetary expansion and contraction. In 1966, once the guidelines broke down, the Johnson administration moves towards fiscal contraction. Historians don’t write about this. The characterization most people get of the Johnson administration, the Vietnam War, certainly something you would hear in an undergraduate lecture, is that, well, the problem with the inflation of the 1960s is that the Johnson administration didn’t raise taxes. That is like an historiographic truth at this point. And it’s wrong. It’s completely wrong.

In November of 1966, Congress repeals a 10% investment credit that was a de facto corporation tax increase. In 1967, things slowed down. Inflation slows down. There is a mini recession. Arthur Okun, one of the members of the President’s Council of Economic Advisers, wrote a book about the Johnson period of political economy and prosperity in which he says 1967 was a “mini recession.” So in that situation, with the guidelines, maybe not everyone is following them, but you have a sort of general contraction, and then the guidelines are an instrument for the government to try to slow things down. And it was viciously fought. That’s the other thing you have to understand. 1967 is the year of the Detroit riot. 1967 is the year of the Newark riot. All of the cities which had been perpetually underfunded are now facing even tighter purse strings from Washington. So you get a precursor of what Nixon actually does in 1967 in the mini recession. But the difference is that, between 1967 and 1969, Nixon lets off the guidelines.

There was a huge explosion in 1969 of wage and price increases because businesses are confronting smaller markets. From a businessman’s perspective, well, you can recoup lost sales volume with higher prices. That makes sense. And from a union’s perspective, it’s survival, because now you’re living in inflation. So the real consumption power of organized workers is being eroded by inflation. So you have to keep money wages going up. That 1969 moment, I think, is really under-appreciated in the economic history of the period, which is usually narrated as, well, the Vietnam War spending kicked off, Johnson didn’t raise taxes, inflation began, and then it lasted until 1979. When, in fact, the story is a lot more nuanced than that. Nixon campaigns, not only on repealing the guidelines, because businessmen hate the guidelines, businessmen see it as a hidden project of price control, which, maybe it was. Nixon campaigns on repealing them as well as on shrinking government spending, or on the excesses of the welfare state, and famously, public universities, but in all sorts of other ways as well. There’s an interesting moment where you see the Republican Party business consensus actually consider expansions to a welfare state.

But anyway, Nixon’s response when he gets into office in 1969 was to cut government spending. His advisors are Herbert Stein, whose book, The Fiscal Revolution, had just come out. He was celebrated as the preeminent expert on fiscal policy and whose own career kind of helped to crystallize the idea of such a thing as fiscal policy as a distinct area of expertise. They advise to cut government spending. So Nixon arrives in 1969. There is the tax increase leftover from the Johnson administration, which they extend. They don’t continue the kind of ambitious social policy expansions of the Johnson administration, and understandably, because that’s what we think of as modern Republican Party ideas, which are being formed at this moment. In addition to fiscal contraction, they get rid of the guidelines. Then, the result is that inflation intensifies. And inflation intensifies as unemployment starts growing. So by the summer of 1970, the unemployment rate is way up and the Republicans lose big time in the midterm elections. And that sort of sets up the avalanching spiral of corruption that is revealed in Watergate.

But it all stems from this summer and fall of 1970 moment, where the administration realizes, “Oh, if we pursue the Orthodox anti-inflation policy here of reducing government spending, raising interest rates, and maybe even raising taxes,” and often it’s like consumption taxes, like raising a sales tax on refrigerators or something, “but if we do all of that, we’re gonna lose the election. Not only are we going to lose the election, but we’re going to intensify the social conflict that has been erupting since the end of the Johnson administration.” 1970 is the sort of height of the anti-Vietnam movement. There’s the National Guard killings at Kent State and the student uprising in Santa Barbara, so there’s a real national chaos in 1970, which austerity only exacerbates. Then, the rest of the next four years you can kind of see emerge out of this problem, which the ruling class solutions are incapable of solving. So Nixon has to sort of improvise.

Maximilian Seijo: I want to hold up here because I think this is really, really important. There are a few theoretical insights that maybe can be pulled from this tale that you’ve told here, the story of this history, as it relates to economic causality. Then, I want to push slightly into The Volcker Shocks and talk about the oil supply shocks as well, because that’s a central part of the narrative. But I think for our listeners, it’s important to say here, that the wage-price spiral, which for any listeners who’ve done an undergrad in economics, such as me, you hear all about this all the time. This is the problem of the last 50 years of macro policy. And it is the problem because of the things that you laid out, Andrew. What’s interesting about your history here is that it inserts price management through guidelines and through price controls, in maybe a larger sense, causally, in a way that almost comes before the chaos of the wage-price spiral.

So the foreclosure of price management, as a policy tool, is what sets the stage for the evacuation of the essential politics, that is, the politics of this situation. So it becomes a purely economic dynamic in the wake, or in the vacuum of, that political evacuation. I wanted to say that because I think that’s a fundamentally crucial thing for us to carry to today in this conversation for talking about the inflation of our moment. And in doing so, I want to push you back into the history. People talk about The Volcker Shock all the time. And, of course, the oil supply and the OPEC embargoes are rich in our consciousness when we’re thinking about this era. What effects did these things have on this wage-price environment?

Andrew Elrod: I think the sort of philosophical distinction between economics and politics that you’re drawing our attention to here is indispensable for understanding what happens during the Nixon administration. And maybe one way of putting it is that the politics of price control had been very clear before Nixon. The federal government had imposed price controls in moments of emergency to protect working class incomes. It was the condition for the successful mobilization of World War II to keep people working in those war factories. You had to have affordable food and you had to have affordable rent. There was a dramatic expansion of rent control during World War II, and similarly, during the Korean War. It was that legacy that motivated the Kennedy experiments in voluntary price control.

But, at the same time, the Washington, Cambridge, Massachusetts, and New York axis came to accept certain perspectives of, frankly, corporate managers. So you end up with a voluntary system. The politics of intervening in price decisions, what otherwise would be private price decisions out of a question of political and civil rights, were protecting working class incomes. There’s a real class politics to it. You make a good point in saying, once price controls were abandoned, politics were evacuated from economic management. But there’s a moment in the history, I would say, that we’re not acknowledging, which is the politics of the Nixon price controls, which when imposed, the Democratic Congress sort of goads Nixon into authorizing this two years in a row.

Then, finally, Nixon does it when he sets up the Cost of Living Council, which is the supervising body under the Secretary of the Treasury for administering the wage and price controls and the mandatory legal price ceilings. He does it in a way that is much more permissive to profit increases than to wage increases. So the politics of the Nixon price controls reverse the class dynamic in the price control apparatus. It becomes an instrument of the ruling class. If you read the radical economists writing about the Nixon price controls, they’re all very explicit about this point. This is a program designed to further immiserate the working class, to pad corporate profits, and to reestablish the commanding position of American corporations in the global economy. They have a real conspiratorial critique and it’s not wrong.

But that’s the view and it’s bolstered by the record of, famously, Arnold Weber, who had been one of the members of the Pay Board. I think he was the commissioner of the Pay Board, which is the wage setting body of the price control program. He told the newspapers, “The goal here is to zap labor. That’s what we’re doing here. We have to get these organized labor unions that are fighting back against inflation across the economy. We have to zap labor.” So that’s where the politics of price control are reversed. And I truly do think that that experience for boomers taught boomers a lesson. It’s dressed up today in all of these formal economic arguments about why price controls don’t work. But I do think there’s a deeper cultural and political memory of the fact that the last time we used price controls it was to hurt the working class. It was an instrument in the class war from above.

So people don’t trust the federal government. And, of course, this is all exacerbated by the fact that during the price control regime, the community to reelect the President is taking all these illegal campaign bribes from the Fortune 500 companies and using them to break into the Democratic Party offices in Watergate and steal Daniel Ellsberg’s psychiatric files, and the plethora of underhanded campaign strategies that became known as “rat fucking.” That’s happening under the price control regime. So this is setting up the popular perceptions, or whatever you want to call it, the American public’s understanding of what goes on under federal power. Your question was about the oil price shocks and The Volcker Shock later in the decade, but I think to understand what’s going on after October 1973 when the Yom Kippur War begins in Palestine and OPEC decides to quadruple the price of oil as a protest, you have to understand what happens from there forward. You have to begin to unpack all of the baggage that had been built up to that moment.

Maximilian Seijo: So this context, I think, is really important. And one of the things I took away from your piece was that the oil shocks, while, as you said, quadrupled the price of oil overnight, these underlying dynamics are often obscured in the memory by that shock of the price at the pump–that you can look up and see going up so rapidly. And not necessarily to get too lost in the weeds, but I wanted to hear you talk about that dynamic, because that’s certainly what I took away from your piece.

Andrew Elrod: This is another important point, I think, that needs to be made in economic history, or in places in economic history where real revision needs to happen. Like the 1967 mini recession that is never taught. The inflation of the Nixon administration begins before the controls. And the pressure on food prices and oil prices begins before the oil shock. This is crucial, because the history is really mistold when it’s explained as, “Oh, the American people knew how to run the American economy.” The experts were in charge, and then there was this unforeseeable, external event that really threw a wrench in the machine. But it’s not true. There had been all sorts of problems in the two years before the oil shock, which, in some ways, allowed us to better weather the oil shock. And one example of this is energy. The price of petroleum, raw crude petroleum out of the ground, and then the refinery price, the price of gasoline, those are all controlled. And that system of controls is the customer of the oil price increase that comes later. As bad as it was, the domestic price of oil didn’t quadruple in 1974. Now, there’s a lot to say about all of that.

Maxximilian Seijo: Yeah, I think we can leave the listeners a bit wanting on some of that. I think that’s a really fascinating point, and actually very much reverses the conventional wisdom that we always hear, which is, of course, like you said, that an external effect threw a wrench in our well functioning–maybe there was some pressure building up–machine.

Andrew Elrod: Before you ask again, there are two points about the pre-OPEC controlled period, I think, to flesh out the story. Raw agricultural commodities, like bushels of corn and wheat, were left outside of the Nixon controls. Since the Great Depression, one of the big things the New Deal does is it brings agriculture completely under federal management. So every year the US Department of Agriculture–really twice a year, because you have multiple planting periods–through the 50s and 60s, determined the preferred planned acreage in the allotment that each farm company–or farmer, there are still some family farms–would plant. The annual supply of raw agricultural commodities was the policy variable they were manipulating. It was a completely planned system.

And in 1972, the high period of Nixon control, even though it’s an instrument against the unions, it did stabilize the economy. Nixon wins reelection in a huge landslide in 1972. During that period, the State Department under Henry Kissinger pivots to détente with China and USSR. Part of the global strategy for people like Henry Kissinger is to restore diplomatic ties with the Soviets and China. And part of that is the grain deal. So we have these huge shipments of like 10-20% of the US agricultural output being sent abroad. As this was becoming known to the price commission, the Cost of Living Council, they became very concerned about the supply of wheat and corn in 1972.

And if you read the record, they publish books with retrospectives with the Brookings Institution, but also just in the newspaper record. They go to the White House and say, “You have to expand plantings, you have to expand supply, if you’re going to ship all of this food to other countries. You have to expand supply at home, otherwise, food prices are going to go up.” So the price of food at the processor and the retail level is controlled, but the price of raw agricultural commodities is not. And, as you know, the simplest economic model would show you the price goes up, or demand exceeds the planned supply. So I think that’s a planning error that should be acknowledged. Now, the second point is about oil.

The record of the oil industry during the Nixon administration is often used as an example of the failure of controls, because prices were controlled in August 1971. There was a freeze, and then they moved into a controls program at the end 1971 into 1972. That’s when the shortages begin. You have gas lines before OPEC. For both the economist and the businessman, his argument is that companies won’t produce at a loss if you control their prices. That it’s too close to cost. There’s no incentive to produce. Nobody’s gonna produce at a loss. That is something that happened in the petroleum industry. But today, there’s a second lesson we can learn from this, because it was seen as a huge failure to have gasoline and petroleum production decline in the 1970s. But today, that wouldn’t be seen as such a terrible thing. In fact, today, the problem of how to reduce petroleum extraction is like a huge problem. There are whole institutes devoted to this, but we have an example of when we actually did it.

Maxximilian Seijo: Credit history really can be cruel sometimes. As we’re sort of coming more to the end of this, there’s something I wanted to ask you about, which is something perhaps more present in my discipline, which is critical humanities. From the more art side and a theoretical approach, there is this narrative around the Marxist analytic of labor and capital as this historical antagonism. Normally, how the story of this era that you’re describing gets told is that this two sided antagonism is tempered through the New Deal, through the war, and then there’s the mid-century period, you could call it some sort of new social contract, where this antagonism is set aside, and we have this prosperity that’s dependent upon external accumulation. But this can’t last, right? There’s a falling rate of return on this social contract. Ultimately, steam builds up, and forgive the mixed metaphors, and the top pops off, and this antagonism comes into its natural state again as a purely economic antagonism.

What I’ve learned from you is that, there are aspects of this story that rhyme with the truth, and certainly the stakeholders, whether they’re regional or corporate, are fighting other stakeholders in what we might call the working class or the unions. This is certainly happening. There are certainly conflicts there. But to me, what your story does is it really nuances and brings this ambivalence around the politics of conflict and antagonism to the fore and perhaps shows these levers of mediation that structure these dynamics. So it’s not that, as you say, the 1970s happens, then there is a pop, and then we’re in this natural state of conflict and it spirals out of control. Those dynamics are in some sense constitutive of things that happen in the world. But there are also political decisions and intellectual debates that really structure the way these conflicts play themselves out. I guess that’s less a question and more of a statement, but I would be curious to hear what you have to say about those not absolutely distinct, but still different stories for narrating this era.

Andrew Elrod: Well, I think the notion of the era of consensus is something that has to be understood in the context of an intensely pressurized organized conflict. There’s a very important article on the 1959 steel strike. In the steel industry, the White House gets involved every time. So three historians, Gabriel Winant, Kristoffer Smemo, and Samir Sonti wrote this great article, critical historical study, about the 1959 steel strike in which they make the larger historiographic intervention that the era of consensus can only be understood as a moment of stalemate and deadlock in a highly organized conflict that had been bequeathed by the experience of the Depression and the organization of the working class that accompanied it. So, as someone who’s influenced by their work, I think the larger roadmap you laid out about interpreting the history of capitalism in the 20th century is useful, but it can be even more useful if we understand the conditions that created the so-called stability, and the political divisions that existed then, which would grow to lead to what is everywhere described as the unraveling, the shattering, or the end of the consensus. You can see it all in embryo, to mix my own metaphors, in the 1950s. You can see it there already.

As a final example of this, with the fiscal contraction that the LBJ administration pursues in 1967, the Vietnam war is going on so it’s not that total government spending is falling, but they want to take spending out of the civilian economy. This is coming at the height of the Civil Rights Movement. So the whole question of what are we going to do about the Black ghetto in the cities, that’s a situation in which you have the left wing of the Democratic Party saying openly, if you want to take money out of the economy, you have to raise taxes on wealthy people. You have to raise corporation taxes. Part of the reason that the tax increase that takes so long to come is this political division about the composition of government spending and who it’s going to go to. You have many high wage white union workers who, in this period, do turn to the right, frankly, out of the racist perception that there’s something unfair going on with the government budget. That’s a really good example of where the detailed institutional history lens helps with the broader conceptual distinction between conflict and consensus, where the organized conflict that produces so-called consensus is beginning to disorganize, and opportunities open for both the ruling class and workers, or the left and the right, or however you want to frame it, but opportunities do open in those periods as well.

Maxximilian Seijo: I think, then, for the last question I want to ask, to this consensus and to these actors who today are arguing in favor of austerity as a solution to the inflation that we’ve seen over the last year, or since the dynamics of the COVID pandemic have started playing out, what would you say to them, in short? And I can even make it a particular person. What would you say to Jason Furman who is arguing that we need a certain type of reduction of demand and that’s the solution?

Andrew Elrod: What are you doing? I can’t imagine ever having an opportunity to talk to that person, but I would say what are you doing? Why is it so important to use your professional expertise and the weight of all of your credentials in this way? Is it more about your profession? Are you truly acting as a good faith historical actor? That’s probably too provocative, I wouldn’t say that. But I think that the class politics of the government budget need to be understood as something more than an abstract full employment level of demand, and that the private sector has really failed to give Americans, people living in the United States, an adequate, basic standard. There are growing tent cities in every city. There’s a generation of people burdened with student debt. People fear the healthcare system–the place that’s supposed to keep you alive. So questions about the government budget should also be considered with this in mind. And if you’re being guided by macroeconomics, that’s a handy instrument to avoid these real questions.

Maxximilian Seijo: I appreciate both the psychoanalytically tinged answer and the straightforward, historically-minded answer. I think they’re both important and two aspects of what we’re contesting today, and where we definitely share a lot of political grounds. So I just wanted to say, Andrew, thanks so much for coming on the show. I really enjoyed this conversation and hope to talk more again soon.

Andrew Elrod: My pleasure. Let’s be in touch.

https://mronline.org/2022/02/02/histori ... rew-elrod/