April 5, 2025

Donald Trump. Photo: Geopolitical Economy Report.

By Ben Norton – Apr 4, 2025

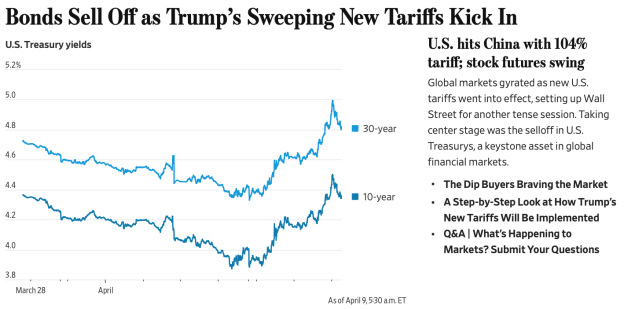

Donald Trump has imposed high tariffs on countries around the world, falsely claiming they are “reciprocal”. Trump’s deeply contradictory policies will likely backfire, hurt the US economy, fuel inflation, and fail to reindustrialize. But rich elites will benefit from tax cuts.

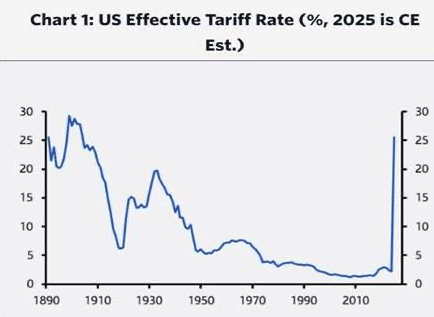

In his first term as president of the United States, Donald Trump launched a trade war against China. In his second term, he has expanded that trade war to many countries around the world.

In a ceremony outside the White House on April 2, which the US president dubbed “Liberation Day”, Trump announced sweeping new tariffs on dozens of countries, including high taxes on imports from top US trading partners: 54% on China, 46% on Vietnam, 25% on South Korea, 24% on Japan, and 20% on the European Union.

Trump falsely claimed that these tariffs were “reciprocal”, but they were actually unilateral. The White House calculated its duty rate on each nation not based on the tariffs it charges on US goods, but rather according to the trade deficit that the United States has with that nation.

It is not surprising necessarily that Trump has expanded US tariffs. During his presidential campaign in 2024, he told supporters at a rally, “The word tariff is the most beautiful word in the dictionary, more beautiful than love, more beautiful than respect”.

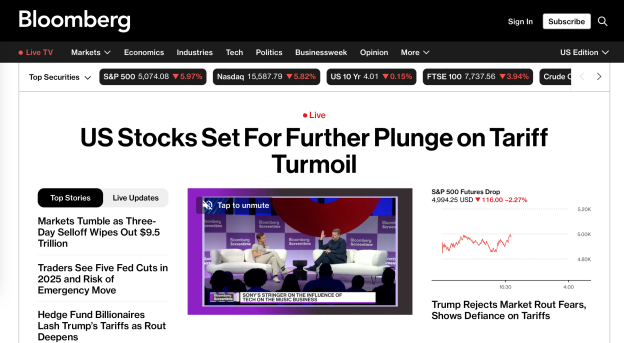

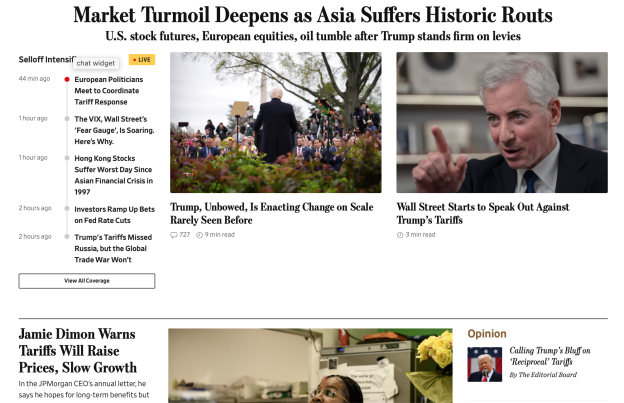

However, what was surprising about the tariffs that Trump announced on April 2 was how massive and broad they were. They will have an enormous impact not only on the US, but on the global economy, and could potentially even cause a recession.

All countries on Earth will face a minimum tariff of 10%. Additional duties will be levied depending on how big a country’s trade surplus is with the US.

The completely contradictory and inaccurate way in which the Trump administration tried to justify this trade war on much of the planet was a reflection of the half-baked and ill-conceived strategy that the White House has proposed to supposedly revive manufacturing in the United States, reduce the chronic trade deficit, and create a new international financial order.

In reality, Trump’s tariff tactics are likely to backfire significantly, fueling high rates of inflation and failing to reindustrialize the US, while incentivizing countries around the world to accelerate their search for alternatives to the United States and the dollar system.

The Trump White House doesn’t understand its own tariff formula

To begin, it must be emphasized that the Trump administration’s claim that US tariffs are “reciprocal” is patently untrue.

The financial journalist James Surowiecki emphasized that the White House “didn’t actually calculate tariff rates + non-tariff barriers, as they say they did. Instead, for every country, they just took our trade deficit with that country and divided it by the country’s exports to us”. He called the methodology “extraordinary nonsense”.

In response, White House Deputy Press Secretary Kush Desai criticized Surowiecki and wrote, “No we literally calculated tariff and non tariff barriers”. (This is false, and it earned a community note correcting it on Twitter.)

Desai linked to an official statement that was published on the website of the Office of the US Trade Representative (USTR), explaining how the tariff rates were determined. This note argued that “individually computing the trade deficit effects of tens of thousands of tariff, regulatory, tax and other policies in each country is complex, if not impossible”, and instead posited that “their combined effects can be proxied by computing the tariff level consistent with driving bilateral trade deficits to zero”.

The USTR then published the formula that it used to determine the tariff rate. Although it employed Greek letters that made the mathematics look complicated, it was in fact very simple: (exports – imports) / imports x 0.5.

When the formula was applied, the tariff rate that the White House announced on all countries could be easily determined and plotted in a straight line:

In other words, the White House spokesperson was wrong and the journalist Surowiecki was correct: the Trump administration’s tariff rates were not based on the tariffs that other countries charge the US, but rather on the trade balance that the US has with other countries.

That is to say, by definition, they are not “reciprocal”; they are unilateral, and aggressive.

What this scandal also showed is that White House spokesmen don’t understand the simple formula that was used to determine Trump’s tariff rate.

Even more absurdly, the statement published by the US Trade Representative cited an academic article that it clearly didn’t read, because it detailed how international trade has been good for US consumers by significantly reducing the costs of goods.

In January, when Trump threatened 25% tariffs on the United States’ neighbors and top two trading partners, Mexico and Canada, the Wall Street Journal editorial board dubbed it “the dumbest trade war in history”. Trump has now expanded that dumbest of trade wars to most of the world.

54% tariffs on China, 46% tariffs on Vietnam, high duties on other top US trading partners

Following “Liberation Day”, top exporters to the US will face very high tariffs.

Trump hit China with tariffs of 54% (34% plus the 20% that was already applied). China is the number one exporter to the US, selling it $438.9 billion in goods in 2024. Top Chinese exports include phones, computers, electric batteries, machine parts, toys, and textiles.

The US president likewise targeted Vietnam with a staggering 46% tariff. Vietnam is the sixth-biggest exporter to the US, selling it $136.6 billion in goods in 2024. Top Vietnamese exports include computers, phones, furniture, semiconductors, machine parts, microphones, and textiles.

Most of the electronics imported into the US come from Asian economies that have been seriously impacted by Trump.

40.7% of US imports of computers are from the Chinese mainland, along with 27.5% from Mexico (which faces potential tariffs of 25%). Another 15% come from Taiwan (which was hit with a US tariff of 32%). An additional 9.42% are from Vietnam.

Sources of US imports of computers

51.8% of US imports of electric batteries come from mainland China, plus 16.6% from South Korea, 6.5% from Japan, 5.39% from Mexico, 5.17% from Germany, and 2.72% from Vietnam.

Sources of US imports of electric batteries

28.3% of the phones imported into the US come from the Chinese mainland, along with 23.1% from Mexico, 9.35% from Taiwan, and 7.54% from Vietnam. An additional 7.03% come from Malaysia (which was hit with a US tariff rate of 24%), and 5.25% from Thailand (which faces tariffs of 36%).

Sources of US imports of phones

Because the tariff rate charged by the Trump administration is based on the trade balance a country has with the US, small nations that export a bit to the US but import little to nothing were hit with enormous tariffs.

The Trump White House absurdly claimed that Cambodia and Laos have trade barriers of 97% and 95%, respectively, so they will face “reciprocal” tariffs of 49% and 48%. The US likewise accused Madagascar of having trade barriers of 93%, so it will endure 47% tariffs.

Most ludicrous of all were the Trump White House’s claims that the tiny African nation of Lesotho (with a population of just over 2 million) and the French territory of Saint Pierre and Miquelon (with a population of less than 6,000) have trade barriers of 99%, so they got hit with a 50% “reciprocal” tariff.

Inflation is coming back in the US

Trump has often falsely claimed that foreign countries will pay for these tariffs, but this is not true. It is US importers that have to eat the cost of tariffs, and they often pass these price increases onto consumers, which causes inflation. (Sometimes a foreign country’s currency will slightly fall against the US dollar in response to tariffs, which can compensate a little for the higher price, but not entirely, and especially when tariffs are as high as 40-50%, any small changes in the exchange rate will not make up for this huge price shock.)

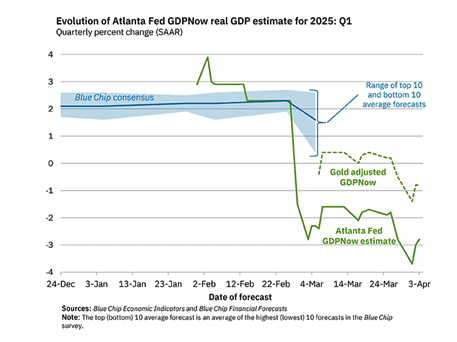

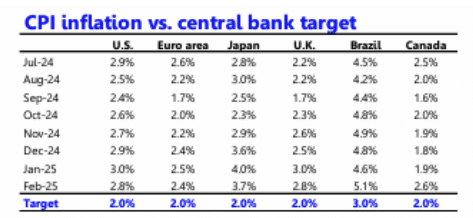

Even before Trump announced the sweeping new tariffs on “Liberation Day”, consumer price inflation was rising in the United States.

The University of Michigan does a survey every month studying inflation expectations in the US.

These surveys show that US businesses were already expecting higher rates of inflation before Trump’s “Liberation Day”. When businesses expect inflation, they hike prices, driving inflation.

The University of Michigan survey has likewise shown a major increase in inflation expectations among US consumers. This has led people to go out and buy products now, before they expect prices to rise, further contributing to inflation. (Charts by Joseph Politano.)

Prices are expected to markedly increase not only for consumer goods like cell phones, TVs, and computers, but also food. As CNBC reported, “Food and consumer business CEOs say tariffs on a wide range of countries will pressure thin margins in an economy where inflation is already elevated”.

Coffee is a clear example. The National Coffee Association points out that, “Since coffee cannot grow in most of the United States—only Hawaii and Puerto Rico—more than 99% of America’s coffee must be imported”. It notes that the US imports 32% of its coffee from Brazil, 20% from Colombia, 8% from Vietnam, and 7% from Honduras.

According to the National Coffee Association, more than 70% of American adults drink coffee at least once per week. So Trump has increased the price of a staple enjoyed by the majority of Americans.

The situation is even starker with fruits and vegetables. The United States imports around 60% of the fresh fruit and 40% of the fresh vegetables sold in the country, according to the US Department of Agriculture (USDA).

Trump’s tariffs will therefore significantly increase the price of produce in the US, especially considering that there are many fruits and vegetables — like, say, bananas, avocados, or mangoes — that cannot be produced in most states in the country.

The fact that Trump’s tariffs are likely going to lead to high levels of consumer price inflation in the US is deeply ironic, because the main reason that Trump won the 2024 presidential election was due to the high rates of inflation suffered in 2022 and 2023, following the Covid-19 pandemic.

Around the world, most incumbent parties lost elections due to this inflation, which was global, and was largely caused by supply chain shocks and the fall in the production of goods during the pandemic lockdowns.

Polls show that the poor state of the economy was the most important issue in the 2024 US election, and many voters associated Democratic President Joe Biden and Vice President Kamala Harris with the inflation. Trump exploited the widespread dissatisfaction with the economy, and he promised to bring down prices. His tariffs will now do the opposite.

Potential goals of Trump’s tariffs

Given the obvious negative side effects, there has been a heated debate as to what exactly Donald Trump’s goals are with these sky-high tariffs.

There are four main theories about why Trump is imposing these tariffs. These potential explanations are not exclusive, and can overlap:

He wants to reduce the US current account deficit (the country’s trade deficit with the rest of the world).

He wants to reindustrialize the United States.

He wants to pressure other countries to agree to a “Mar-a-Lago Accord”, which would help the US reshape the international financial system (that the US itself created) to even better serve its interests.

He wants to use tariffs to replace government revenue lost due to large tax cuts on the rich and corporations.

Reduce the US current account deficit?

Using tariffs to try to reduce the US current account deficit does not make sense, given the role of the dollar as the global reserve currency (which will be addressed in a following section), as well as the inevitable retaliation by US trading partners.

If Trump thinks he can use tariffs to bring the US trade deficit with each country to zero, he clearly has underestimated the ability of other countries to respond with tariffs of their own.

If the US wants to reduce its trade deficit with other countries, by definition it has to export more to them. But other nations have announced that they will respond to Trump’s unilateral, aggressive tariffs with actual reciprocal taxes on US goods.

This means that Trump’s tariffs will cause US exports to those countries to fall, even as their exports to the US fall.

China and the European Union immediately made it clear that they would respond to Trump’s unilateral tariffs with their own reciprocal measures.

Moreover, consumers in countries targeted by Trump’s tariff threats, from Canada to France, have vowed to boycott US goods in protest, which could make the trade deficit even worse, or least cause overall trade to fall.

Reindustrialize the United States?

In his White House speech dubbing April 2 “Liberation Day”, Trump claimed the date “will forever be remembered as the day American industry was reborn”.

Nevertheless, if Trump truly wants to reindustrialize the US, imposing tariffs on the rest of the world is not going to magically do that on its own.

Every single advanced economy that has industrialized in history has done so with a concerted industrial policy, in a state-led industrial-upgrading campaign in which the government drove investment in infrastructure, education, and key manufacturing sectors; developing human capital, training workers, and providing subsidies and cheap loans to strategic firms.

Rebuilding US manufacturing will take many years, if not decades. It requires enormous investment in infrastructure, the physical construction of large factories, the reshoring of complex global supply chains, and the training of workers. Relying on the private sector alone to do this is totally unrealistic.

Targeted tariffs in specific industries where a country wants to “catch up” could be a useful tool, but only as part of a larger industrial policy. If the US wanted to promote local manufacturing of, say, semiconductors, electric vehicles, or solar panels, limited tariffs in those sectors could help. This is what the Joe Biden administration attempted. However, what Trump is doing is completely different. Widespread blanket tariffs on countries around the world are not a tool of industrial policy; they are a form of trade war.

Instead of crafting a coherent industrial policy, Trump is imposing austerity and eroding government capacity, mixing Reaganomics with protectionism.

Rather than investing in education and job training programs for reindustrialization, Trump is signing executive orders to dismantle the Department of Education.

Trump has even torn up the very bare-bones attempt at industrial policy that was pursued by the Biden administration, undoing the Inflation Reduction Act (IRA) and attacking the CHIPS Act.

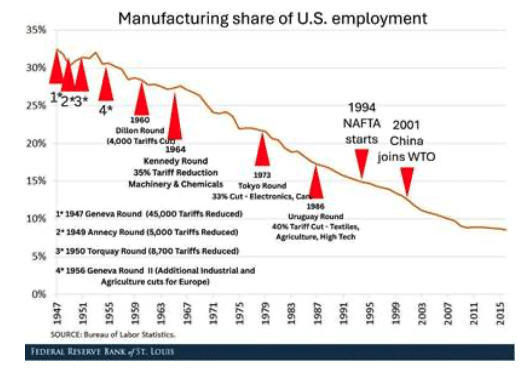

This will not reindustrialize the United States. In fact, it was exactly this kind of neoliberal ideology that led the US economy to be deindustrialized in the first place.

The US financial sector was deregulated under Ronald Reagan in the 1980s, and then Bill Clinton in the 1990s. This deregulation, combined with the emergence of new digital technologies, made it much more profitable for US capitalists to invest in the financial sector, not in manufacturing.

The Jack Welch model of CEOs incentivized corporate executives to pump up stocks, promising fat bonuses for those who did so.

Instead of investing in expanding production, US corporations plowed their net income into stock buybacks. In 2014, Bloomberg reported that among the top 500 publicly traded companies in the US, in the S&P 500 stock market index, 95% of their earnings went to buying back their own stocks and paying dividends to shareholders.

Until the US government fundamentally changes its policies toward the financial sector, heavily taxes capital gains, and incentivizes companies to invest in local manufacturing, they are going to continue to prioritize financial speculation over tangible production.

The fact that the US private equity industry is flourishing is the perfect symbol of how US capitalists don’t want to create a new company or build new factories, because it is considered too risky and not profitable enough. They can much more easily earn high returns on investment by simply buying up existing companies, laying off their workers, and asset stripping them. That’s the entire business model of private equity’s infamous corporate raiders, who have gotten fabulously wealthy in the neoliberal era.

Instead of trying to solve those deep, structural problems, Trump is doing the exact opposite: the billionaire US president and the dozen other billionaires in his administration are slashing taxes on the rich and corporations, implementing austerity, and weakening the state. This will not reindustrialize the economy.

A “Mar-a-Lago Accord”?

Another explanation given for Trump’s tariffs is that he hopes to use them as leverage to force countries to come to the negotiating table for a so-called Mar-a-Lago Accord.

According to this idea, Trump wants to restructure the international financial system — which was designed by the United States at the end of World War Two to serve its interests, but which Washington is no longer happy with, because it has lost its former unipolar hegemony.

The narrative of the Mar-a-Lago Accord is that it will be a grand deal that will allow Trump to bring down the overvalued US dollar, force “allies” (read: vassals) to pay for US military “protection”, and help reduce the US federal debt by ordering vassals to buy long-dated Treasury securities (like, say, 100-year bonds) with low coupon rates, meaning they will lose value over time and act as a kind of foreign subsidy for the US government.

The man Trump appointed as the chair of the Council of Economic Advisers, Stephen Miran, published a report outlining a very loose framework for a hypothetical Mar-a-Lago Accord, which has been discussed with bated breath in the financial press.

The problem with this idea is that the United States will have to force other countries to violate their own interests on behalf of Washington. For so-called “allies” who have been militarily occupied by the US for decades, like Japan, South Korea, or Germany, this may be possible (although even that is not guaranteed).

But it is highly, highly unlikely that Trump will be able to pressure large countries of global macroeconomic significance, like China, Russia, India, or Brazil (in other words, BRICS nations), to agree to a Mar-a-Lago Accord.

Reagan’s Plaza Accord of 1985 is often cited as Trump’s model. However, this deal was imposed on US vassals Japan, the UK, West Germany, and France, which have a close military partnership with the US. Moreover, their position in the world economy today is much weaker than it was then.

Chinese economists and policymakers have closely studied the disastrous effects that the Plaza Accord had on Japan, by overvaluing its currency, hurting the competitiveness of its exports, and fueling a catastrophic asset price bubble. It is practically impossible to imagine that China would agree to sign a similar deal that could lead to the same outcome.

Trump thinks access to the large US market is the silver bullet that can be used to pressure countries to sign such a Mar-a-Lago Accord. He would love China to raise the value of its currency, the renminbi, so Washington can devalue the dollar, but this would hurt China’s own manufacturing sector on behalf of the US.

For China, US market access is not as important as it once was. China does still export a lot to the United States, but the situation is shifting rapidly. ASEAN, the Association of Southeast Asian Nations, has already overtaken the US as China’s largest trading partner.

Although 14.67% of China’s exports still went to the US in 2024, that figure had fallen substantially from 19.23% in 2018.

China has already spent a decade diversifying its trade relations, so it is no longer so reliant on the US.

Ending dependence on trade with the US was one of the key goals of China’s Belt and Road Initiative, which was launched in 2013 to create the physical infrastructure needed to economically integrate the Global South in a post-US world.

Signs of this increasingly multipolar world can be seen everywhere.

A clear example was the fact that, in response to Trump’s tariffs threats, Vietnam invited China’s President Xi Jinping and European leaders to meet in Southeast Asia to discuss trade plans.

The Trump administration may believe it can strong-arm the world into signing a metaphorical or literal Mar-a-Lago Accord, but it is unlikely to have the impact that it wants in a world where the US has lost so much of its dominance.

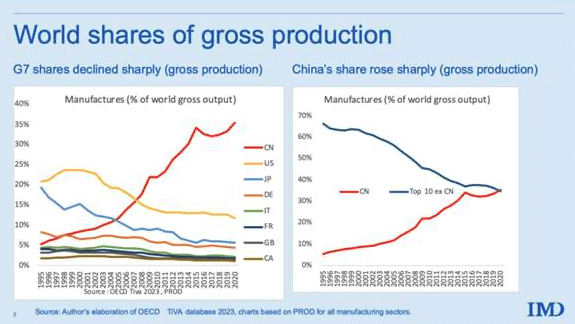

In 1944, when the Bretton Woods Conference was held, the United States made up roughly 35% of global GDP, and it was the world’s manufacturing superpower.

Today, China represents more than 19% of world GDP (PPP), compared to less than 15% for the US, and China’s share is growing over time, whereas that of the US is shrinking.

China is now the world’s manufacturing superpower, and the US is frantically scrambling to reindustrialize.

The situation is completely different, and Washington no longer has the leverage it enjoyed at the end of World War Two, when most of the world’s advanced economies were physically destroyed and the US was the only real game in town.

The role of the US dollar

The role of the US dollar as the global reserve currency is at the center of the contradictions faced by the Trump administration.

If Donald Trump’s goal with his tariffs is to reduce the trade deficit that the US has with the rest of the world (its current account deficit), one of the best ways to do that would be to end the role of the dollar as the global reserve currency.

However, Trump is doing the exact opposite of that. The aim of the Mar-a-Lago Accord is to save US dollar dominance by creating a new US-dominated international financial order.

Trump is so desperate to preserve the “exorbitant privilege” of the US currency that he has threatened 100% tariffs on BRICS members and other countries that de-dollarize and drop the use of the dollar in their international trade.

“We will keep the US dollar as the world’s reserve currency”, Trump pledged during his 2024 presidential campaign. “Many countries are leaving the dollar. They’re not going to leave the dollar with me. I’ll say, ‘You leave the dollar, you’re not doing business with the United States, because we’re going to put 100% tariff on your goods’”.

As president, Trump has claimed that “BRICS is dead” due to his tariff threats. “I told them if if they want to play games with the dollar, then they’re going to be hit with a 100% tariff”, Trump said in a press conference in the White House. “Since I mentioned that, BRICS died”.

Despite Trump’s false claims to the contrary, BRICS continues to expand apace. In January, the Global South-led organization accepted as a new member Indonesia, the fourth-most populous country, with the world’s seventh-largest economy. A few days later, BRICS added as a partner Nigeria, Africa’s most populous nation.

BRICS represents 54.6% of the world population and 42.2% of global GDP (PPP), as of January, despite Trump’s threats.

Trump’s desire to maintain dollar dominance while also reducing the US trade deficit is utterly contradictory. One of the main reasons for this massive deficit is because of the role that the US plays in the world economy as the issuer of the global reserve currency, and essentially the banker of the planet.

By definition, the inverse of the US current account deficit is the US capital account surplus.

What does that mean? It means that, because the dollar is the global reserve currency, other countries around the world need to get access to dollars. How do they get those dollars? The US has to run a trade deficit with other countries, otherwise they won’t have the dollars they need for the dollar to remain the global reserve currency.

This is part of the famous Triffin Dilemma, which has been popularly discussed for six decades.

Foreign businesses that export products to the US are paid in dollars. The US essentially prints debt and buys those products with that debt. Those dollars go into the bank account of the foreign exporter. Foreign investors then use those dollars to invest in US assets, buying US stocks, real estate, and Treasury securities. This causes the capital account to go into surplus.

If Trump wants to end the current account deficit, he would also have to end the capital account surplus, which would mean an end to net foreign capital flows into the US.

This would be catastrophic for Wall Street — one of the main constituencies of billionaire Trump and the fellow billionaires who fill his administration.

If somehow Trump managed to reduce the US current account deficit to zero, other countries wouldn’t have the dollars they need to keep using the currency in international trade. But Trump has warned that if those nations stop using the dollar in international trade, he is going to hit them with 100% tariffs. This would in fact force them to de-dollarize their international trade.

So what does he want?

It appears that Trump does not understand the basics of the balance of payments, which is why his contradictory policies make no sense.

The real solution to this structural problem would be to move to a different kind of system, like the model that was originally proposed by John Maynard Keynes at the Bretton Woods conference in 1944.

Keynes wanted to create a Bancor, an international unit of account whose value would be based on a basket of different commodities and/or currencies. This would be supplemented by an International Clearing Union that could help reduce global trade imbalances, by incentivizing surplus countries to increase imports and deficit countries to boost exports.

Credit: Radhika Desai

That would be an actual solution. But instead of doing anything remotely similar, Trump and his alleged “Mar-a-Lago Accord” plan seek to preserve US dollar dominance by rewriting the rules of the international financial system that were written by the United States in the first place, and blackmailing and bullying any countries that refuse to go along with it.

The more the US pushes nations around, nevertheless, the more they will seek alternatives to the US-led imperial order — which is precisely what has been happening for the past decade.

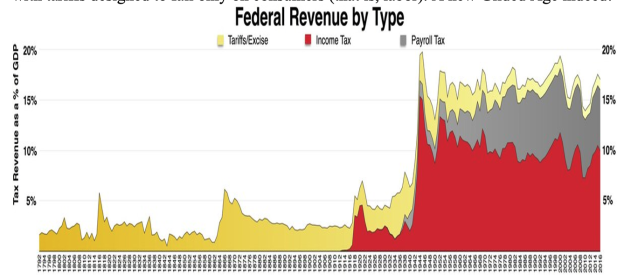

Replacing income taxes with tariffs

This leaves the final theory to explain Trump’s tariffs: that they could be an alternative revenue source for the US government.

Trump has publicly stated that he would like to replace income taxes with tariffs. It now seems that he is attempting this with his huge tariffs on countries around the world.

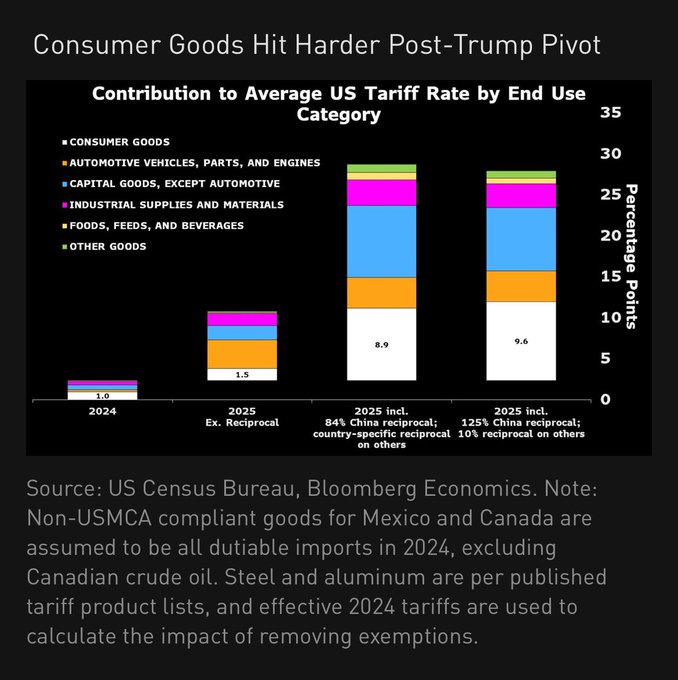

While Trump slashes taxes on the rich and corporations, he hopes to make up for lost revenue by taxing imports. This will disproportionately hurt the majority of the population, while benefiting a small handful of wealthy elites.

This idea is mathematically illiterate, as tariffs could not generate nearly enough revenue to make up for reduced income taxes — but that has never stopped Trump before.

Tariffs are essentially a tax on consumption, given the US imports so many consumer goods. Tariffs are also an extremely regressive tax. They put the burden of taxation on the poor and working class, who spend much more of their paychecks on cheap imported consumer goods, and have a high marginal propensity to consume.

Consumption by the rich is not significantly impacted by tariffs, and they have a low marginal propensity to consume. So tariffs are Trump’s way of imposing an enormous regressive tax, moving the burden of taxation off of capital and onto labor.

The US income tax system is already quite regressive in practice. On paper, it is supposedly progressive, but there are many loopholes for wealthy elites, and thanks to Trump’s tax cuts on the rich during his first administration, as of 2018, billionaire families in the US payed a lower tax rate than the bottom half of poor and working-class Americans.

Tariffs will be even more regressive. The Budget Lab at Yale University published an analysis in response to Trump’s April 2 “Liberation Day” tariffs estimating: “The price level from all 2025 tariffs rises by 2.3% in the short-run, the equivalent of an average per household consumer loss of $3,800 in 2024$. Annual losses for households at the bottom of the income distribution are $1,700”.

In short, if Trump’s alleged attempts to reindustrialize the US and/or broker a Mar-a-Lago Accord fail, at the very least, Trump and his billionaire allies will see their taxes significantly reduced, and the burden of taxation will have been moved onto poor and working-class Americans.

For Trump, that seems to be more than enough reason to impose sky-high tariffs.

(Geopolitical Economy Report)

https://orinocotribune.com/this-is-why- ... s-economy/

******

USDA Cuts Hit Small Farms as Trump Showers Billions on Big Farms

Posted on April 6, 2025 by Conor Gallagher

Conor here: I’m picking up an overarching theme here from Team Trump.

By Kevin Hardy, who covers business, labor and rural issues for Stateline from the Midwest. Cross posted from Minnesota Reformer.

Anna Pesek saw a federal program supporting local food purchases as much more than a boost to her Iowa pork and poultry farm.

The U.S. Department of Agriculture grant program that allowed schools and food banks to buy fresh products from small farms helped her forge new business relationships. It allowed her to spend more with local feed mills and butchers, and was starting to build a stronger supply chain of local foods.

But now that the Trump administration has yanked the funding, she worries that rural economic boost might end too.

“With the razor-thin margins on both sides, those partnerships are just really hard, if not impossible, to sustain,” she said.

The co-owner of Over the Moon Farm, Pesek said her operation was never entirely reliant on the local food programs; it represented about 10% of her business. While she knew the federal money wouldn’t last forever, she was planning on the funding lasting through 2028 — but then the Trump administration last month nixed more than $1 billion for local food programs.

The federally funded Local Food Purchase Assistance and the Local Food for Schools programs, both begun during the pandemic, focused on small, local farms in aims of building stronger domestic food supply chains. Grants allowed schools and food banks to buy meat, dairy and produce from small farms — including many healthy products that are often too expensive for those institutions.

USDA’s local food programs specifically aided some of the nation’s most disadvantaged farmers and ranchers, including newcomers, small farmers and those who have faced racial discrimination.

The local food programs were initially funded by 2021’s American Rescue Plan Act but were later expanded by the Biden administration. The Trump administration, though, has cut the funding that went to thousands of small farms, saying that it’s instead “prioritizing stable, proven solutions that deliver lasting impact.”

Pesek noted that the federal government has subsidized commodity agriculture like corn and soybeans for more than a century.

“It’s not a novel idea, right? This is how the relationship between the federal government and farmers has looked,” she said. “And so all this program did was allocate some of the funds to go to different kinds of farmers versus just commodity farmers.”

Just after cutting the local food programs, USDA announced it was expediting $10 billion in direct payments to commodity farmers through the Emergency Commodity Assistance Program, which helps farmers offset high input prices and low sale prices for crops. The White House is reportedly considering billions more in farm subsidies as President Donald Trump escalates global trade wars.

Andy Ollove, food access program director at Fresh Approach, a California nonprofit that works on building a healthier and more resilient food system, said the government’s long-standing farm subsidies flow to some of the nation’s biggest operators. Conversely, the local food programs benefited small farmers and communities directly.

“The economic multiplier to this program just seems way more impactful than the traditional subsidy model of the USDA that the administration is continuing to invest in,” he said. “It’s just a giveaway.”

Fresh Approach has helped administer the food bank program in California. While implementation delays mean farmers won’t lose access to the program as quickly as in other states, he expects elimination of the program to put small farmers out of business across the country.

Some states have launched their own local food programs, but nothing on the scale of the federal investment. That’s left advocates for small farmers, local foods and food banks pushing for reinstatement of the federal program or getting it included in the next round of farm bill negotiations, when Congress outlines a five- or six-year spending plan for the nation’s food policy and agriculture sector.

Ollove expects philanthropists will fund parts of California’s program after federal money is depleted. But it won’t have the same reach.

“I do feel confident that these types of programs will continue in California … sporadically and piecemeal,” he said. “But not in the way that we’re administering it, in a way that I think is changing a lot of things and improving the food system.”

A Mixed Response from the States

The noncompetitive USDA local food grants allowed many new farmers to break into markets. And the aid for food hubs, which link small producers to larger markets, helped farmers distribute products to schools and food banks.

In Wisconsin, for example, more than half of the nearly 300 farmers who benefited from the food bank program were early career farmers, according to state officials.

In Illinois, the state prioritized funds toward socially disadvantaged farmers, such as those who have faced racial or ethnic prejudice.

“Attacking this program was really an attack on Illinois’ most vulnerable, whether it’s a socially disadvantaged farmer or the food recipient,” said Kristi Jones, deputy director of the Illinois Department of Agriculture.

Her department administered the federal food bank program, which helped beginning farmers get their businesses off the ground.

“A lot of these farmers, they’re living their dreams,” she said. “They are living their goals because of this program.”

Illinois had been planning on nearly $15 million from the next round of funding for the food bank program. Jones said farmers already had begun planning and spending on seeds and equipment.

“You just don’t put something on the ground and have the product the next day,” she said. “ … So that uncertainty was incredibly challenging for farmers who already deal with enough uncertainty.”

Democratic leaders have bashed the Trump administration’s decision: Illinois Gov. JB Pritzker, for example, called it “a slap in the face to Illinois farmers and the communities they feed.”

But conservative leaders in other states have downplayed the cuts.

In Texas, Agriculture Commissioner Sid Miller characterized USDA’s decision as “a reassessment.”

He said the state was not dependent on the federal funds and would continue its Farm to School and Farm to Food Bank programs, which encourage the local purchase of Texas agricultural products.

“There’s always room for refinement, and we may see a revised version of the policy down the road that is even better for agriculture producers,” he said in a statement last month.

Texas funds programs to help distribute excess food to schools, food banks and charities. But it does not have a grant program like USDA’s to help those organizations purchase local food, said Marshall Webb, spokesperson for the state agriculture department.

Iowa’s agriculture department recently started its own local food program.

The Choose Iowa program has made about $300,000 available to support local food purchases — though the state lost out on about $11.3 million because of the federal cuts.

Don McDowell, spokesperson for the Iowa Department of Agriculture & Land Stewardship, said the agency would continue to ask lawmakers to expand funding for the Choose Iowa program.

“Programs designed to forge relationships between Iowa farmers, food hubs, food banks and schools are important to our farmers and communities,” he said.

Iowa Farmers Union President Aaron Heley Lehman said his organization, which represents family farmers and ranchers, would like to see the state step in to fill the void.

“But we don’t anticipate that that’s going to be an easy thing for the state of Iowa to do,” he said. “So not only is it local farmers that are feeling like they’ve had the rug pulled out from underneath them, but the state of Iowa has, too.”

Creating a New Food System

In Southern California, Dickinson Family Farms has worked to gather produce from dozens of small farms across the region, allowing even the smallest operators without distribution capabilities to sell to local food banks.

Andrew Dickinson, who owns the farm with his father, said the federal local food program also helped reduce food waste. Farmers were able to get fair market prices for vegetables with cosmetic damage or fruits deemed too small or large for grocery store shelves.

Dickinson said the federal program has provided a reliable marketplace for small operators that otherwise depend on more inconsistent sales streams like farmers markets.

“It will create a vacuum,” he said.

About 60 miles east of Los Angeles, sixth-generation farmer Anna Knight said the federal funds were much more than a handout to farmers. To her, they were about creating a new kind of food system.

She said supporting local producers creates more supply chain resilience — something many people didn’t appreciate until the pandemic.

“We don’t want to go back to that world,” she said. “When we invest in our local food system, we’re really investing on onshoring our food production system, on making new food systems local and increasing their resiliency in moments of crisis.”

Old Grove Orange, her California farm, has been supplying citrus to some local school systems for years. But she said the federal funds were the “single biggest changemaker” for pushing schools to buy local for the first time.

To her, that’s key in promoting lifelong healthy eating: Local produce like her freshly picked oranges pack more of a nutritional punch and just taste better than produce that takes weeks to ship from abroad.

“When you are giving a child a delicious piece of fruit, you are really cultivating their palate for life,” she said. “You are setting this expectation of what a fruit is supposed to taste like, and you are sparking this love for fruits and vegetables for the rest of their life.”

Knight said the nation doesn’t have to choose between big and small farms. But small farms are vanishing all around her.

“This is a ticking bomb,” she said. “The clock is running out if we don’t really find a way to help make these small, medium-sized farms sustainable.”

https://www.nakedcapitalism.com/2025/04 ... farms.html