Trump accelerates US imperial collapse

July 7, 2025 , 4:33 pm .

Michael Hudson: "America's power no longer lies in being a creditor, but in being a debtor from whom no one can collect... until an alternative appears." (Photo: Getty Images)

At the end of World War II, the United States placed the dollar at the center of the international financial system, with the support of the International Monetary Fund and the World Bank. For decades, this architecture allowed Washington to finance its military spending and external deficits through the purchase of Treasury bonds by foreign central banks.

In an interview with Norwegian academic Glenn Diesen, economist Michael Hudson warns that this model has reached a critical point. "Empires don't pay," he asserts, noting that US debt has become its main instrument of power, but also its greatest weakness.

The confiscation of Venezuelan and Russian reserves, the threat of sanctions against any country that moves toward de-dollarization, and other factors have undermined confidence in the system. Saudi Arabia, India, and other Washington-allied actors are seeking alternatives in gold or bilateral agreements outside the dollar.

Hudson sums up the dilemma: "America's power no longer lies in being a creditor, but in being a debtor from whom no one can collect... until an alternative appears."

The double-edged power of the big debtor

The United States has accumulated more than $35 trillion in public debt. For Michael Hudson, this massive liability has become an instrument of power. Foreign creditors depend so heavily on the Treasury's strength that they fear provoking a crisis if they demand abrupt repayment. Hence President Donald Trump's threats ( tariffs of up to 500% on anyone who abandons the dollar) and the bipartisan insistence on calling any attempt at de-dollarization a "hostile act."

The current architecture was developed after the oil embargo of the 1970s. Washington allowed OPEC to quadruple the price of crude oil on the condition that the profits returned to the United States. Saudi Arabia invested a large portion of those petrodollars in Dow Jones stocks, always without decisive voting power. Thus, rising oil prices covered the US deficit and kept producers tied to the dollar.

Half a century later, that pact is showing cracks. The dollar accounted for 71% of global reserves in 1999; in the third quarter of 2024, that share fell to 57.4% , its lowest level in thirty years. This trend is less due to the rise of other currencies than to concerns about the legal security of assets deposited in the United States and Europe.

The decisive precedent was Iran in 1979, the American economist explains. Chase Manhattan Bank refused to process an interest payment, and the Islamic Republic was declared bankrupt, allowing its funds to be seized. This logic has been repeated with the Venezuelan gold held at the Bank of England and with the nearly $300 billion in Russian central bank assets frozen by the G7 since 2022.

The message that large holders of dollar assets receive from this is that access to their reserves depends on alignment with U.S. foreign policy. If any attempt to distance themselves from the U.S., the United States can respond with sanctions, tariffs, or even a freeze on their reserves.

This way of thinking is evident in the country's internal economy. Instead of investing in factories, technology, or development, large companies prefer to make money quickly through financial transactions, Hudson explains.

Just as the United States uses its debt as a tool of international pressure, many of its large companies use their own financial resources to maintain internal control without producing more, buying back their own shares to increase their market value.

For example, in 2024, companies comprising the S&P 500 index repurchased $942.5 billion in shares , an all-time high. And in the first quarter of 2025 alone, they had already repurchased $293.5 billion .

For comparison, total corporate spending on research and development (R&D) for 2023 was $940 billion—almost the same amount, but spread across thousands of companies and sectors.

Companies are using the money to inflate their own stocks, rather than improving their productive capacity. As Hudson says, "Wall Street thinks about the next quarter; factories take decades." This has led to the United States losing ground in key industries such as semiconductor and advanced machinery manufacturing, causing other countries to begin to distrust the dollar as a symbol of a strong economy.

In 2022, the Federal Reserve raised interest rates to 5.25%–5.50%, the highest level since 2007. According to traditional economic rules, this should have caused the dollar to rise in value, because it offers more benefits to investors.

But the opposite happened. The DXY index, which measures the dollar's value against other major currencies, has fallen more than 10% so far in 2025.

"Arbitrage, as European and Asian countries call it, consisted of borrowing cheaply in their own countries and buying those high-yield Treasury bonds, like 10-year bonds with a 4.5% interest rate.

Well, suddenly, that doesn't work anymore. And that's what has the Treasury Department and those who are trying to figure out how we're going to pay panicking. The United States is becoming what England was after World War II: plodding along, unable to sustain itself.

Why? Because many investors no longer find it attractive to buy US debt, even if it pays more interest. If they have to exchange their euros or yen for dollars, and then the dollar falls, they lose more than they earn in interest.

This worries the US government. If foreign investment were to cease, it would become much more expensive to finance the public debt, which already exceeds $34 trillion. Furthermore, when interest rates rise, borrowing within the country becomes more expensive. This causes companies to invest less and worsens trade with other countries.

Trump accelerates the breakup

Donald Trump has turned his trade policy into a tool of pressure against countries trying to distance themselves from the dollar. This stance is accelerating the collapse of the US-led international financial system.

"Their tariff policy essentially threatens to deny them the U.S. market if they don't agree to stop trading with China, if they don't refuse to de-dollarize, and, in essence, if they don't surrender their economies to U.S. control," Hudson says.

Added to this are public threats and actions such as imposing a 10% tariff on foreign purchases of Treasury bonds, which would reduce or even eliminate any profits for those financing US debt. There is also the intention to raise tariffs to 60% for Chinese products and 20% for other regions, in what Hudson describes as a deliberate strategy to close the US market to those who do not align with his economic and geopolitical vision.

"Trump has said that if you try to buy US Treasury bonds with a 4.5% yield, he'll charge you a 10% fee and tariff on the purchase of those bonds. So, in reality, you'll lose money on them."

Countries like Saudi Arabia and the United Arab Emirates, which hold large reserves of US assets, are concerned that these funds could be used as punishment.

"Other countries are losing, in their own currency, the value of the dollars they hold. So Trump is accelerating the farewell. He's closing the US market to them. And that means: do it yourself, folks. Make your own deals," Hudson says.

Diesen, who interviewed Hudson, points out that no system based solely on force and pressure can last long.

Therefore, the same tools that made the dollar a dominant currency can now lead to its downfall. Raising rates no longer attracts investment. Large companies prefer to profit on the stock market rather than invest in real production. And tariffs scare the very countries that sustain global demand for dollars.

No clear alternative, but with incentives to seek it

The dollar's global dominance is no longer based on the strength of the US economy, but on the lack of a clear alternative. Although many countries distrust the Washington-controlled financial system, there is currently no viable option to replace it. That is why the dollar remains central to global transactions, the economist argues.

However, the incentives to build an alternative are becoming increasingly evident. China, oil-exporting countries, and other economies with trade surpluses are beginning to develop their own payment systems, bilateral agreements in local currencies, and strategic alliances that exclude the dollar.

In response, the United States is not offering a renewed proposal, but rather a policy of containment to prevent the emergence of an alternative. This includes sanctions, diplomatic pressure, punitive trade measures, and, in some cases, military action.

"Obviously, the countries with the largest trade surpluses are the logical candidates to promote an alternative: China, the oil-exporting countries. That's why the US has designated China, and any country that seems strong enough to create an alternative, as an enemy."

Hudson argues that the current global conflict is a clash between economic models. The US model is based on financial profitability, while China, for example, focuses on productive investment, infrastructure, and long-term growth.

This internal transformation, along with sanctions and the militarization of its foreign policy, is accelerating the deterioration of global confidence. Hudson cites the recent escalation of the war with Iran as an example of how the US responds to any actor seeking economic independence. Wars like the one in Ukraine also aim to wear down Russia and block the consolidation of alternative systems to the dollar.

"We are trying to drain the Russian economy through the war in Ukraine. (...) This is the key to understanding not only American diplomacy, but also the US military action against Iran today, which is part of its attempt to control the entire Middle East."

The only sustainable way out for the United States would be a profound reindustrialization. This would entail abandoning dependence on Wall Street and returning to generating value through real production. But Hudson sees little likelihood that Congress will accept such a transition, because short-term financial interests and a nationalism that refuses to cede power or conform to global rules prevail.

In the short term, the trend is clear: other countries and blocs like the BRICS+ are already creating agreements outside the dollar system. Trump's policies only accelerate this process. According to Hudson, the system can be maintained for a while longer, but not indefinitely. Every coercive measure that seeks to sustain it ends up pushing the world toward its replacement.

https://misionverdad.com/globalistan/tr ... al-de-eeuu

Google Translator

******

Trump Dismisses Musk’s Threats of New Political Party

X/ @maddenifico

July 8, 2025 Hour: 8:02 am

The Republican politician called the idea ‘ridiculous,’ adding that it would cause confusion and chaos.

U.S. President Donald Trump has dismissed billionaire entrepreneur Elon Musk’s threats to form a third political party to rival Democrats and Republicans.

“I’m saddened to watch Elon Musk go completely ‘off the rails,’ essentially becoming a TRAIN WRECK over the past five weeks,” Trump said and called that idea “ridiculous,” adding that it would cause confusion.

The feud between the two billionaires began in early June after Musk blasted Trump’s landmark One Big Beautiful Bill, a gargantuan tax and spending package that Trump signed into law on Friday, the Independence Day.

Musk lambasted the legislation, saying it could add trillions of U.S. dollars to the national debt. “Today, the America Party is formed to give you back your freedom,” he said.

In response, Trump posted on social media that third parties “have never succeeded in the United States,” adding that “the one thing (they) are good for is the creation of complete and total disruption & chaos.”

In reaction to these statements, some political analysts have commented on the viability of the formation of a new partican with the capacity to become an effective third electoral option in the United States.

“Right now, Republicans have narrow margins in both chambers of Congress. If Musk were to fund primary challengers or independent general election candidates… that could cost Republicans in next year’s midterms. Building a real party, rather than a vanity project, would involve finding and running credible candidates up and down the ballot, for unglamorous offices like school board and city council,” said Christopher Galdieri, a political science professor at Saint Anselm College.

“Things like this have been tried not very long ago… The problem is that a political party needs a core idea. This venture would have to attract people younger than 45 who are already politicians on some level, and who have real political talent. If Musk were to just concentrate on knocking out specific Republican senators and members, that would be a slightly better plan than starting a new political party,” said Clay Ramsay, a researcher at the Center for International and Security Studies at the University of Maryland.

“There are lots of people who would like choices between the two major parties. Each has moved to the extremes and does not represent the broad swathe of America. He needs to find someone to lead the party who could appeal to more people,” said Darrell West, a Brookings Institution senior fellow.

https://www.telesurenglish.net/trump-di ... cal-party/

******

Trump Caves Again Over Tariffs - Uncertainty Increases

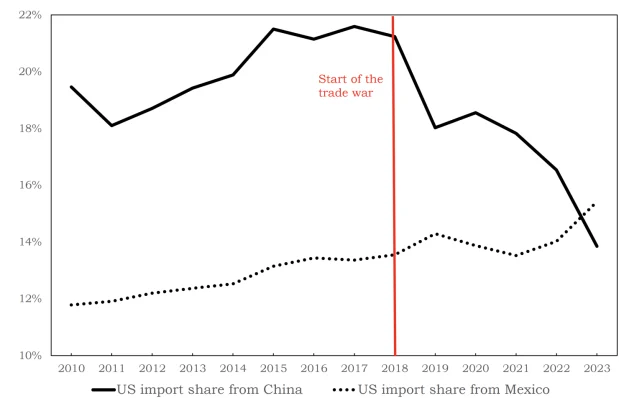

On April 2 U.S. President Donald Trump declared a 'Liberation Day' by introducing tariffs on nearly all imports to the United States.

I dared to predict:

The 'invisible hand' of the markets will respond to Trump's moves by showing him a very visible finger.

The following days confirmed my take.

The tariff rates Trump announced were basically picked from hot air. The whole idea behind them were based on the weird theories of Steve Miran, the Chairman of Trump's President Council of Economic Advisors. They did not make sense.

By April 9 the markets hit back:

Treasury yields spiked on Wednesday as investors bailed out of what has been perceived as the world’s safest instrument on expectations of crumbling foreign demand as tariffs take effect.

...

Yields settled down after China called for dialogue with the U.S. on trade, and then moved right back near the highs of the day after China said it was increasing its tariffs on the U.S. to 84%.

...

“Something has broken tonight in the bond market. We are seeing a disorderly liquidation,” said Jim Bianco, president and macro strategist at Bianco Research.

Shortly thereafter Trump had to pull back (archived):

The economic turmoil, particularly a rapid rise in government bond yields, caused Mr. Trump to blink on Wednesday afternoon and pause his “reciprocal” tariffs for most countries for the next 90 days, according to four people with direct knowledge of the president’s decision.

Trump's unsteadiness on tariffs increased the uncertainty of economic decisions. Uncertainty is a poison, suppressing real economic activities.

The Federal Reserve Bank St. Louis produces hundreds of economic statistics. It includes several which are measuring uncertainty:

That FRED graph only included February. The doubt about Trump's economic policies had pushed it that high. The consequences of his tariff games were not yet visible.

Here is the current FRED overview graph of economic uncertainty. The index has reached a new record high:

When Trump had pulled back and announced his 90 days pause on tariffs, he and his advisors were hopeful that other countries would come to negotiate:

PETER NAVARRO:

...

So that's what we set, knowing full well, knowing full well that a lot of countries would come right to us and want a bargain. We've got 90 deals in 90 days possibly pending here.

Up to today, two days before the 90 day pause on tariffs expires, no trade deal was done. There are three new 'framework agreements' - with the UK, Vietnam, and China - which are more or less just letter's of intent but not agreements.

With the tariff pause ending, and no trade deals done, the Trump administration is forced to extend its tariff pause:

Treasury Secretary Scott Bessent said Sunday that the U.S. will revert to steep country-by-country tariff rates at the beginning of August, weeks after the tariff rate pause is set to expire.

...

CNN host Dana Bash responded to Bessent on Sunday, saying, “There’s basically a new deadline,” prompting Bessent to push back.

“It’s not a new deadline. We are saying this is when it’s happening,” Bessent said. “If you want to speed things up, have at it. If you want to go back to the old rate, that’s your choice.”

On Friday, Trump, too, referred to an Aug. 1 deadline, raising questions about whether the July 9 deadline still stands.

The Trump administration is also moving the goalposts. Instead of negotiating trade agreements with individual countries the administration will just send out letters of, so far, unknown content:

Trump said Friday that the administration would start sending letters to countries, adding, “I think by the 9th they’ll be fully covered.”

“They’ll range in value from maybe 60% or 70% tariffs to 10% and 20% tariffs, but they’re going to be starting to go out sometime tomorrow,” Trump said overnight on Friday. “We’ve done the final form, and it’s basically going to explain what the countries are going to be paying in tariffs.”

Trump said in a Truth Social post late Sunday evening that tariff letters would be delivered starting at noon on Monday.

There is only one country who's people will have to pay those tariffs and the is the U.S. itself.

There is little reason for other countries to react in any other way to the U.S. than by imposing symmetrical tariff measures. For many of them U.S. markets are no longer important enough. That is why most countries have simply ignored the matter:

Bessent also said Sunday that “many of these countries never even contacted us.”

The whole Trump strategy of imposing tariffs to regain industrial activity and to impose its political aims on other countries have failed. China and the EU, the U.S. biggest trade partners, have not flinched. Others have followed their example.

Meanwhile the damage imposed by heightened trade uncertainty continues to accumulate. People are already paying higher prices.

A year from now, when the 2026 midterm elections come up, the damage from tariffs will be what really matters.

Posted by b on July 7, 2025 at 15:17 UTC | Permalink

https://www.moonofalabama.org/2025/07/t ... .html#more

******

Trump’s Self-Destructive Fight with the Fed for Low Interest Rates: His “Fiscal Dominance” Game of Chicken

Posted on July 7, 2025 by Yves Smith

Donald Trump holds many contradictory beliefs and pursues them with vigor rather than making tradeoffs. A prominent example is his fight with Fed chair Jerome Powell over interest rates. Trump wants them lower because he thinks it will reduce inflation and be good for business.

So far, Trump has been losing. The central bank has been holding the line since the economy still seems strong and Trump’s tariffs are destined to have an inflationary impact (although how much is yet to be determined). Trump’s threats to fire Powell led interest rates to notch up, so he has backed off and is sulking by engaging in a range war with Powell. Trump has harrumphed that he will replace Powell in 2026 and will even name a shadow Fed chair to try to contest Powell’s authority. I anticipate that will be as effective as the out-of-power party speeches right after the State of the Union.

Interest rate policy has come into even more intense focus with the passage of Trump’s “big beautiful bill” which sets the US on a path of yawning budget deficits when there were already worries a plenty over the sustainability of US debt levels. As we will soon explain below, some pundits have depicted Trump as engaging in a fiscal dominance strategy, of forcing the Fed to weigh funding, as in interest rate, costs, heavily in setting its interest rate policy. World War II is a precedent; the Fed kept interest rates at 2% for much of its duration. But though wholesale prices rose at an average rate of over 8%, real incomes were also increasing by an average of over 4%. So this bout of inflation did not damage the financial position of workers.

Not only does our current situation not resemble that of the US on a total war footing, but as we have explained repeatedly, the idea that putting money on sale via low interest rates is a boon to productive activity is misguided, as widespread and protracted ZIRP/low rate experiments have shown. High interest rates will choke business borrowing and thus crimp some activities, witness the famed quip by former Fed chair William McChesney Martin, ““The Federal Reserve…is in the position of the chaperone who has ordered the punch bowl removed just when the party was really warming up.”

But low rates do not simulate activity, or at least not the sort that is terribly desirable. Businesses do not take the risk of borrowing to expand their activities just because the price of money fell. Their first consideration is whether commercial opportunity, such as expanding geographically or launching a new product, exists. They then weigh any funding cost as part of this assessment (recall the biggest source of funds for businesses is retained earnings, and not the use of debt).

So what enterprises might go out and expand if interest rates are low, particularly in real terms? Ones where interest expenses are the biggest, or one of the biggest, expenses. That means leveraged speculators, like private equity, hedge funds, banks…and real estate developers. So at best, Trump is generalizing from personal experience, which is not applicable to the economy as a whole. Of course, he may also be unduly responsive to the pleas of big financier donors who benefit from low interest rates.

Trump might hope for lower interest rates boosting the economy via mortgage refis. This was a big stealthy source of stimulus in the post financial crisis period. The Wall Street Journal even has a fresh front page story lamenting how many recent homebuyers made the bad bet that they could buy a house at a somewhat favorable price due to elevated mortgage rates, then refi when their hoped-for rate decline materialized. From Homeowners Who Gambled on Lower Rates Are Paying the Price:

This real estate adage that a buyer should “marry the house and date the rate” has often worked in the past. Millions of homeowners refinanced in 2020 and 2021 when mortgage rates fell to historic lows. Many of them saved hundreds of dollars a month on mortgage payments.

But rates haven’t dropped below 6% since September 2022, and economists don’t expect a return to the lows of a few years ago.

With mortgage rates staying higher for longer, those who had hoped to refinance within a year or two are stuck. The housing market remains divided between homeowners who locked in cheap borrowing costs and those who are burdened by higher monthly payments…..

And if rising tax or insurance costs have pushed up homeowners’ monthly payments while their incomes haven’t changed, that could make it difficult for them to qualify for a new loan.

The problem with the line of thought is that “policy” rate cuts may not translate into much if anything in the way of declines in interest rates at longer maturities. Mortgage rates are typically set off the “belly of the curve” as in the 7 year rate. And in the early 1990s, Greenspan dropped short-term interest rates very low, the back end of the curve did not move much. Here, with pretty much every financially literate person in the US expecting the durable and rising inflation between Trump’s massive fiscal stimulus and tariffs goosing many costs, it’s hard to fathom how the Fed relenting on rates have much impact on intermediate and longer-term interest rates.1

Admittedly, if the US engineers persistent high inflation, banks may start to offer floating rate mortgages as they did in the later 1970s and early 1980s. This product has acceptable risk if the mortgage has interest rate ceilings and floors (mine did).

The low mortgage rates of the post crisis period were THE reason for QE. Bernanke kept explaining, and too few listened, that the Fed was buying longer-dated Treasuries and high quality mortgage securities, such as Fannies and Freddies, to target mortgage interest spreads. The Fed was at the front line of the operation to restore housing prices via favorable mortgage interest rates. Many borrowers were “under water” as in the current value of their house was lower than their mortgage balance. The fear was that if these homeowners would default if they were under financial stress, since they could reasonably see themselves as throwing good money after bad in trying to keep their house.2

Even though they are too committed to Trump’s incoherent scheme to admit it, Treasury Secretary Scott Bessant’s plan to opportunistically (as in for the foreseeable future) fund at the short end of the curve is lowering investor confidence in Trump’s policies. Lower confidence = higher perceived risk = higher required return = higher interests rates. From Bloomberg in Bessent Is Treating Treasury Like a Hedge Fund:

Two things can be true at the same time: First, Treasury Secretary Scott Bessent is generally right to avoid terming out the US government’s debt at the high prevailing borrowing costs. Second, he is being hypocritical given that he criticized his predecessor for leaning into short-dated bill issuance.

Here’s Bessent’s exchange on Monday with Bloomberg’s Sonali Basak:

Basak: At what point do you start issuing at longer-dated maturities?<

Bessent: Well, why would we do it at these rates? We are more than 1 standard deviation above the long-term… rate, so why would we do that? The time to have done that would have been in ’20, ’21, ’22.

As a matter of tactics, I increasingly agree with Secretary Bessent, who no doubt has plenty of experience timing the market from his years as a hedge fund manager….

All of that can be true, but Bessent is still openly flouting the standards of Treasury market issuance. When Janet Yellen was leading Treasury, Bessent criticized her for precisely the policy that he’s now pursuing. Bessent claimed that Yellen was being fiscally imprudent by pushing up sales of short-dated bills. While bills have lower interest costs than notes and bonds (in normal yield curves), they mature sooner and open up the government to volatility over the short- and medium-run….

Bessent is now openly bucking the time-honored Treasury principle of “regular and predictable” funding. Some four decades ago, Treasury officials decided that regular and predictable — as opposed to tactical — issuance decisions were among the best ways to keep government funding costs at their lowest possible levels over time. Since then, Treasury has declared quite explicitly that it doesn’t seek to time the market.

How common is this view? I have no idea. But Trump’s tariff fixation whipsaws alone give reason to question the competence of his economics team. Beating up on Powell and desperate-looking Treasury funding approaches can’t help.

Now to the “fiscal dominance” issue, that Trump intends to force the central bank’s hand and lower rates to accommodate his yawning fiscal deficits and funding needs.3 From Wall Street Journal economics editor and Fed whisperer Greg Ip in Trump’s ‘Fiscal Dominance’ Play:

A flood of new bonds to finance deficits would normally put upward pressure on long-term interest rates. Trump’s Treasury is trying to short-circuit that mechanism, signaling that debt issuance will tilt toward shorter-term securities and Treasury bills.

This is a gamble. If short-term rates jump, the cost quickly hits the budget. Trump, though, doesn’t intend to let that happen….

A central bank that shifts its priorities from employment and inflation to financing the government has succumbed to “fiscal dominance.” It is usually associated with emerging markets that have weak central banks, such as Argentina. The result is typically some combination of inflation, crisis and stagnation.

Getting to that point, though, can take years. Meanwhile, fiscal dominance can be a powerful stimulant. While fiscal dominance isn’t yet the status quo in the U.S., the mere possibility might be influencing markets. Lower interest rates, aided in part by the prospect of a change in Fed leadership, coupled with deficit-financed tax cuts, have helped the stock market romp to new records….

Back in May, House Republicans unveiled their version of Trump’s “one big, beautiful bill.” It would have pushed the deficit from $1.8 trillion last year, or 6.4% of gross domestic product, to $2.9 trillion in 2034, or 6.8% of GDP, according to the Committee for a Responsible Federal Budget.

The U.S. has never before run such large deficits for so long. As bidding at Treasury bond auctions turned sloppy and Moody’s stripped the U.S. of its triple-A credit rating, 10-year Treasury note yields climbed to 4.55%.

The bill that passed Thursday is even more profligate: Deficits rise to $3 trillion, or 7.1% of GDP, in a decade. And if temporary tax cuts in the bill are extended, as the 2017 tax cuts have been, the deficit climbs to $3.3 trillion, or 7.9%, CRFB projects. And yet yields closed Thursday at 4.35%.

Yields have fallen for several reasons, including mild inflation and softer labor market data…

If governments could borrow as much as they wished and set interest rates by fiat, why don’t more do it? Because there is no free lunch. If interest rates are persistently too low, something bad will happen, usually inflation.

Ip’s orthodox account is not correct. One reason unduly low rates come to tears is that they fuel speculative asset bubbles, which when they implode, do great damage to asset holders. They severely rein in spending, producing an acute recession or even a depression.

A particular adverse scenario here is that the Trump yawning deficits won’t fund much in the way increases in productive capacity. So the great increase in demand produced by such large net fiscal spending with no corresponding increase in economic capacity will directly increase inflation.4

John Authers at Bloomberg has a similar discussion, although his piece is framed around the notion that central bank independence is the least bad approach on offer:

With the US now bearing its highest peacetime debt load in history, Trump wants monetary policy to be subjugated once again to the needs of managing official debt. Forcing the public to lend to the government at unrealistically low rates of interest is one way to deal with the deficit — but the spectacle of the One Big Beautiful Bill shows that there’s value to an independent central bank empowered to tell politicians they’re not going to help them avoid difficult choices. No wonder foreign traders are losing their faith in the dollar.

The St. Louis Fed, in a paper by banking expert and regular industry advocate Charles Calomiris, in Fiscal Dominance and the Return of Zero-Interest Bank Reserve Requirements, gives the “Beyond here lie dragons” view of fiscal dominance. Nevertheless, he usefully points out that in sustained period of fiscal dominance, central banks have an ugly tendency to use more and more bank reserves to shore up their operations. Mind you, this practice is based on the widely-held yet disproven loanable funds theory, that borrowings come from a pre-existing pool of savings, as opposed to are created ex nihilo. Key parts of the paper:

Under current policy and based on this report’s assumptions, [government debt relative to GDP] is projected to reach 566 percent by 2097. The projected continuous rise of the debt-to-GDP ratio indicates that current policy is unsustainable.

—Financial Report of the United States Government, February 16, 2023

The above quotation from the Treasury’s Financial Report admits that the current combination of government debt and projected deficits is not feasible as a matter of arithmetic because it would result in an outrageously high government debt-to-GDP ratio. But when exactly will the US hit the constraint of infeasibility, and how exactly will US policy adjust to it?…

Fiscal dominance refers to the possibility that the accumulation of government debt and continuing government deficits can produce increases in inflation that “dominate” central bank intentions to keep inflation low. …

The essence of fiscal dominance is the need for the government to fund its deficits on the margin with non-interest-bearing debts. The use of non-interest-bearing debt as a means of funding is also known as “inflation taxation.” Fiscal dominance leads governments to rely on inflation taxation by “printing money” (increasing the supply of non-interest-bearing government debt). To be specific, here is how I imagine this occurring: When the bond market begins to believe that government interest-bearing debt is beyond the ceiling of feasibility, the government’s next bond auction “fails” in the sense that the interest rate required by the market on the new bond offering is so high that the government withdraws the offering and turns to money printing as its alternative….

If the US government faced a fiscal dominance problem, it would have to fund real deficits by real inflation taxation, which is a limited tax resource. Thus, not all real deficits are feasible to fund with inflation taxation…

Given the small size of the currency outstanding, if the government wishes to fund large real deficits, that will be easier to do if the government eliminates the payment of interest on reserves. This potential policy change implies a major shock to the profits of the banking system.

Second, as the history of inflation episodes has shown, even an inflation tax base of currency plus zero-interest reserves would decline in real terms in the face of a significant increase in inflation. Based on data for the US as of 2023, the resulting inflation rate could be very high…

For that reason, it is quite possible that a fiscal dominance episode in the US would result in not only the end of the policy of paying interest on reserves, but also a return to requiring banks to hold a large fraction of their deposit liabilities as zero-interest reserves. For example…requiring banks to hold 40 percent of deposits as zero-interest reserves, under reasonable assumptions, would reduce the annual inflation rate to fund likely deficits from an inflation of about 16 percent to only about 8 percent….

The history of inflation taxation around the world has shown that when governments become strapped for resources, they often use zero-interest reserve requirements to tax banking systems and remove their spending constraints…

Taxing banks with reserve requirements and zero-interest reserves is convenient for two reasons. First, instead of new taxes enacted by legislation (which may be blocked in the legislature), reserve requirements are a regulatory decision…

Second, because many people are unfamiliar with the concept of the inflation tax (especially in a society that has not lived under high inflation), they are not aware that they are actually paying it, which makes it very popular among politicians…

Such a policy change would not only reduce bank profitability but also reduce the real return earned on bank deposits to substantially below other rates of return on liquid assets, which potentially could spur a new era of “financial disintermediation,” as …occurred in the US in the 1960s and 1970s.

There’s a lot wrong with this orthodox tale, but it’s likely to prove popular as normal mechanisms for funding Trump’s spending excesses run into more and more difficulty. One is Calomiris acting as if paying banks to hold reserves is a sound practice. It isn’t. It was a post-crisis scheme to subsidize banks; the nominal reason was to have a “better” way to manage short-term interest rates (the very long-established mechanism was to have the New York Fed act directly in the market, buying and selling Treasuries). In keeping with the interest on reserves not being such a hot idea, the 2019 repo panic was the direct result of the Fed engaging in its first-time-ever tightening under its interest-on-reserves regime. Mere months earlier, the two most senior members of the Fed’s New York money markets desk had abruptly resigned, one wonders over having sounded warning about what might go haywire in a tightening cycle with new mechanisms. That meant a dearth of seasoned hands on deck to stabilize markets the old-fashioned way.

However, Calomiris is probably correct that banks will suffer adjustment pains if they were denied their “interest on reserves” subsidy.

A second looming issue is that Calomiris fails to see that bond issuance to fund Federal spending in excess of receipts is a political convention, a holderover from the gold standard era, and not an operational necessity. Reader Karl did a fine job of debunking that idea in a recent post:

“The government still has to borrow money from somewhere.”

This is current practice, but MMT says (and I agree) that the sovereign has the discretion to depart from this practice and “spend money into existence”. The idea of borrowing and paying interest is a matter of sovereign choice, and it increasingly appears to be an arbitrary (but very expensive) choice that now costs the U.S. $1 trillion/yr in interest charges.

If you have an exclusive right to the issuance of the only universal reserve currency, and pay zero interest, other Sovereigns will still choose to hold it as a “reserve” up to a point — but not excessively so. In this way countries with trade surpluses will have every incentive to let their currencies appreciate once they have the “rainy day” reserves they need to keep the IMF off their backs. It is our outmoded legacy system from the days of the gold standard that maintains the fiction that we must “bribe” the world with interest to hold dollars, and therefore the interest-bearing debts keep piling up and the trade deficits continue.

If the U.S. government were to announce, tomorrow, that it would henceforth monetize all deficits; cease selling debt securities; and let all bonds expire at maturity, eventually the interest charges on the entire U.S. debt will go to zero.

When will such a policy be instituted? When interest charges go to $2 trillion? $10 trillion? The total keeps growing faster than GDP, so it seems the “debt singularity” will happen eventually.

The gold standard is not dead. We just adhere to the same rituals as if the dollar had to be as precious as gold, more precious than health care or other safety nets. Republicans today think, a la Grover Norquist in years past, that all this social spending is like so many unwanted kittens, and deserve to be drowned in the fiscal (blood) bath. Republicans can see the day of reckoning coming when we’ll drown those kittens so we can keep paying those interest charges. They are patient.

We have to start discussing the alternatives. Japan has shown the way. All we have to lose is our chains to a bygone era.

Sadly, Trump’s lack of attachment to norms is not likely to extend to government financing, at least in ways that could prove beneficial.

_____

1 There is always the risk of a Great Depression level crash, which would severely depress economic activity and inflation pressures. So there is a scenario where low rates are again the order of the day, but it’s not a pretty one.

2 At the time, we argued fiercely that this “strategic default” meme was vastly overdone, since defaulting on a mortgage, aside from the personal upheaval, was very damaging to one’s credit ratings and employment prospects. We did think that there were “anticipatory defaults” as in borrowers halting payments before they were completely out of money so as to have some cash in the till so they could move into a rental.

3 Yours truly doubts this is a Trump plan, as opposed to the result of his various actions.

4 A colleague argues that one reason the Administration hearts crypto is that it drains money supply. The wee problem is that despite the many economists and media banging on regularly otherwise, money supply increases do not cause inflation. See Japan as the textbook case. That fact was demonstrated decades ago via monetarist experiments under Thatcher and Reagan. Monetary velocity is not remotely stable so theories based on money supply having macroeconomic effects are bunk.

https://www.nakedcapitalism.com/2025/07 ... icken.html

******

‘The Land of Performance’: Trump wanted a Perfect War, a Headline Showstopper

Alastair Crooke

July 8, 2025

“Depending on who you ask, the US bombing of Iran’s nuclear facilities in Fordow, Natanz and Isfahan was either a smashing success that severely crippled Tehran’s nuclear programme, or a flashy show whose results were less than advertised … In the grand scheme of things, all of this is just drama”.

The big issue – second only to ‘what next in Iran’ and how they might respond — says Michael Wolff (who has written four books on Trump), is “how the MAGA is going to respond”:

“And I think he [Trump] is genuinely worried, [Wolff emphasises]. And I think he should be worried. There are two fundamental things to this coalition – Immigration and War. Everything else is fungible and can be compromised. It’s not sure those two elements can be compromised”.

The signal from Hegseth (‘we are not at war with the Iranian people – just its nuclear programme’) clearly reflects a message being ‘walked back’ in the face of MAGA pushback: ‘Pay no attention. We’re not really doing war’ is what Hegseth was trying to say.

So, what’s next? There are basically four things that can happen: First, the Iranians can say ‘okay, we surrender’, but that’s just not going to happen; the second option is protracted war between Iran and Israel with Israel continuing to be attacked in a way that it has never been attacked before. And thirdly there is attempted regime change — although this has never been successfully achieved by air assault alone. Historically, America’s regime changes have been accompanied by mass slaughter, years of instability, terrorism and chaos.

Lastly, there are those who warn that nuclear Armageddon is on the table with the aim of destroying Iran. But that would be a case of self-harm, since it likely would be Trump’s Armageddon too — at the midterm elections.

“Let me explain”, says Wolff;

“I have been making lots of calls – so I think I have a sense of the arc that got Trump to where we are [with the strikes on Iran]. Calls are one of the main ways I track what he is thinking (I use the word ‘thinking’ loosely)”.

“I talk to people whom Trump has been speaking with on the phone. I mean all of Trump’s internal thinking is external; and it’s done in a series of his constant calls. And it’s pretty easy to follow – because he says the same thing to everybody. So, it’s this constant round of repetition …”.

“So, basically, when the Israelis attacked Iran, he got very excited about this – and his calls were all repetitions of one theme: Were they going to win? Is this a winner? Is this game-over? They [the Israelis] are so good! This really is a showstopper”.

“So again, we’re in the land of performance. This is a stage and the day before we attacked Iran, his calls were constantly repeating: If we do this, it needs to be perfect. It needs to be a win. It has to look perfect. Nobody dies”.

Trump keeps saying to interlocutors: “We go ‘in-boom-out’: Big Day. We want a big day. We want (wait for it, Wolff says) a perfect war”. And then, out of the blue, Trump announced a ceasefire, which Wolff suggests was ‘Trump concluding his perfect war’.

And so, suddenly — with both Israel and Iran apparently co-operating with the staging of this ‘perfect war headline’ — “he gets annoyed that it doesn’t run perfectly”.

Wolff continues:

“Trump, by then, had already stepped into the role that ‘this was his war’. His perfect war. Television drama at the highest level: War to create a headline. And the headline is ‘WE WON’. I’m in charge now and everybody is going to do what I tell them. What we saw subsequently was his frustration at the spoiling of an outstanding headline: They’re not doing what he tells them”.

What is the broader ramification to this mico-episode? Well, Wolff for one believes Trump is unlikely to get sucked into a long complex war. Why? “Because Trump simply does not have the attention span for it. This is it. He’s done: In-boom-out”.

There is one fundamental point to be understood in Wolff’s analysis for its wider strategic import: Trump craves attention. He thinks in terms of generating headlines — each day, every day, but not necessarily the policies that flow from that headline. He seeks daily headline dominance, and for that he wants to define the headlines via a rhetorical posture — moulding ‘reality’ to give his own showstopping Trumpian ‘take’.

Headlines then become, as it were, a sort of political dominance which can subsequently metamorphose into policy — or not.

Nonetheless, it will not be quite as easy as Wolff suggests for Trump to simply ‘move the spotlight on’ from Iran — although Trump is a master at finding a new point of contention. For fundamentally, Trump has committed himself to the ancillary headline of ‘Iran will never have a bomb’. Note that he does not define that in policy terms, but gives himself wiggle-room for a possible later victory claim.

Yet, there is another fundamental point here: The Israeli attack on Iran on 13 June was supposed to collapse Iran like a house-of-cards. That is what Israel expected — and what Trump clearly expected too: “[Trump’s phone calls on the eve of the Israeli surprise attack] were all repetitions of one theme: Were they going to win? Is this a winner? Is this game-over? [The Israelis] are so good! This is really a show–stopper”. Trump foresaw the possible collapse of the Iranian State.

Well … it wasn’t ‘game over’. Israelis may be hugging themselves in excitement at the Mossad pièce de théâtre on 13 June; at the ‘professionalism’ of Mossad-led decapitations; the assassinations of scientists, the cyber and the sabotage attacks. Mossad is acclaimed by many in Israel — yet all were tactical achievements.

The strategic objective — the ‘be all’ and ‘end all’ of it — was a bust: The ‘House-of-Cards’ did not implode. Rather, it powerfully rebounded. Instead of Iran being rendered weaker, the attack succeeded in firing-up Shia and Iranian national identities. It has ignited a largely dormant national fervour and passion. Iran will be the more resolute in the future.

So, if the Israeli 13 June assault didn’t succeed, why would the plan go any better second time around and with Iran fully prepared? A long attritional war with Iran may be Netanyahu’s preference to fuel his own hoped-for ‘Great Victory’ headline. But Netanyahu cannot now pursue such delusions (neither can Israel survive an attritional war) – without substantive American help (which might not be forthcoming).

Though Trump’s very evident queasiness (as painted by Wolff’s interlocutors) over whether the Israeli sneak attack would prove to be a quick win or not, is suggestive of Trump’s inner temper: “Is this a winner? Is this game-over? It needs to be a win: It has to look perfect: In-boom-out”.

These repetitive enquiries to those around him spell more a lack of self-confidence, rather than suggest that he wants — or has the attention span — for a long-drawn out slug-match, bereft of a clear ‘game over’ moment.

Too, he will be rightly fearful of the effect on his MAGA base of a long war, as well as on young Trump voters (who are already beginning to drift away from Trump – as focus group polls suggest). Trump’s majorities in both Houses are incredibly precarious. $300m could tip them either way.

Recall too, the second fundamentally important point is that Israel was attacked in a way that it has never been attacked before. Israel still hides the extent of the damage inflicted by Iranian missiles; but even senior Israeli security watchers – as they digest the incrementally exposed extent of damage done to Israel — are drawing the bitter lesson that the Iranian ‘programme’ may not be able to be destroyed by military means. But only through a diplomatic agreement of some sort — if at all.

Regime Change also has been revealed as a chimaera. Iran has never been as united and as steadfast as it is now. The threat to kill the Supreme Leader also completely backfired. Four Shia leading religious authorities (Marja’iyya), including the celebrated Grand Ayatollah Sistani in Iraq, have issued rulings that any attack on the Supreme Leader would trigger a jihad fatwa obligating all of the Ummah (community) to join with religious war on America and Israel.

Negotiations between the US and Iran reaching an agreed outcome seem far off. The IAEA has made itself a major part to the problem, rather than forming any part of a solution. Trump’s attention span on the Ukraine ‘ceasefire’ ploy seems to be ebbing — and this possibly might be the eventual outcome with Iran too. Long negotiations leading nowhere, as Iran quietly re-starts its enrichment programme. And presumably Israel launching further assaults on Iran, leading to Iran’s inevitable response – and escalation.

https://strategic-culture.su/news/2025/ ... owstopper/

******

Imperial Hypocrisy About “Terrorism” Hits Its Most Absurd Point Yet

“Terrorist” just means “anyone who inconveniences the empire in any way.” It really is that simple.

Imperial Hypocrisy About “Terrorism” Hits Its Most Absurd Point Yet

“Terrorist” just means “anyone who inconveniences the empire in any way.” It really is that simple.

Caitlin Johnstone

July 8, 2025

The US has removed Syria’s Al Qaeda franchise from its list of designated terrorist organizations just days after the UK added nonviolent activist group Palestine Action to its own list of banned terrorist groups.

The western empire will surely find ways to be even more hypocritical and ridiculous about its “terrorism” designations in the future, but at this point it’s hard to imagine how it will manage to do so.

Antiwar’s Dave DeCamp writes the following:

“Secretary of State Marco Rubio announced on Monday that the Trump administration is revoking the Foreign Terrorist Organization (FTO) designation for Hayat Tahrir al-Sham (HTS), the al-Qaeda offshoot that took power in Damascus in December 2024.

“HTS started as the al-Nusra Front, which was the official al-Qaeda affiliate in Syria until the group’s leader, Ahmed al-Sharaa, who is now Syria’s de facto president, rebranded. In 2016, Sharaa, who was known at the time as Abu Mohammad al-Jolani, announced he was disassociating from al-Qaeda, and thanked the ‘commanders of al-Qaeda for having understood the need to break ties.’

“Sharaa renamed his group HTS in 2017 and ruled Syria’s northwestern Idlib province until he led the offensive that ousted former Syrian President Bashar al-Assad at the end of last year. The US has embraced the new Syrian leader despite his al-Qaeda past, which included fighting against US troops in Iraq.”

This move comes as Sharaa holds friendly meetings with US and UK officials and holds normalization talks with Israel, showing that all one has to do to cease being a “terrorist” in the eyes of the empire is to start aligning with the empire’s interests.

So that was on Monday. The Saturday prior, the group Palestine Action was added to the UK’s list of proscribed terrorist groups under the Terrorism Act of 2000, making involvement with the group as aggressively punishable as involvement with ISIS.

The “terrorism” in question? Spraying red paint on two British war planes in protest against the UK’s support for the Gaza holocaust. A minor act of vandalism gets placed in the same category as mass murdering civilians with a car bomb when the vandalism is directed at the imperial war machine in opposition to the empire’s genocidal atrocities.

Even expressions of support for Palestine Action are now illegal under British law, leading to numerous arrests over the weekend as activists expressed solidarity with the organization. Pink Floyd’s Roger Waters, who is British, has been formally reported to UK counterterrorism police by UK Lawyers for Israel following the musician’s public statement saying “I support Palestine Action. It’s a great organisation. They are non-violent. They are absolutely not terrorist in any way.”

So let’s recap.

Nonviolent protest against a genocide that’s being backed by the western empire: Terrorism. Banned. Nobody’s allowed to support this.

Being actual, literal Al Qaeda but aligning with the interests of the western empire: Not terrorism. Okie dokie. This is fine.

These hypocrisies and contradictions of the empire are worth drawing attention to because they clearly show that the empire does not stand where it claims to stand. For decades we’ve been told that western military explosives are falling from the sky in the middle east and Africa because there are terrorists there who need to be stopped, but it turns out “terrorism” is just a meaningless label that means whatever the empire needs it to mean at a given time and place.

Iran’s IRGC is labeled a terrorist group because the Iranian military is not aligned with the US empire. Israel’s IDF is not labeled a terrorist group despite its constant use of violence upon civilian populations in order to advance political goals. Palestine Action is labeled a terrorist group because it opposes the empire’s genocidal atrocities. Al Qaeda in Syria is no longer a terrorist group because it’s making nice with Israel and doing what the empire wants.

“Terrorist” just means “anyone who inconveniences the empire in any way.” It really is that simple.

https://caitlinjohnstone.com.au/2025/07 ... point-yet/