RT: MOSCOW’S ANTI-SANCTIONS TSARINA: WHAT A WOMAN LEADING RUSSIA’S CENTRAL BANK SAYS ABOUT ECONOMIC WAR WITH THE WEST

JANUARY 3, 2024

RT, 12/28/23

The head of the Bank of Russia, Elvira Nabiullina, has held the position for more than ten years. When she was just starting the job, the world media highlighted that Nabiullina had become the first woman to run a central bank in a G8 country. Now, however, Western media talk about her in a completely different context. Not long ago, Politico magazine named her “disruptor of the year” because she “has managed to stave off the effects of unprecedented Western sanctions designed to drain the Kremlin’s coffers.”

In her first interview since Russia’s military engagement with Ukraine began, Nabiullinatold RBK about the toughest sanctions and the delayed key-rate increase, and specified whether subsidized mortgages will become rare in the future.

This is a complete translation of this interview, made by RT especially for our readers.

“This is a highly negative signal for all the central banks”

— The financial sector was the first one to get hit by the sanctions. The largest banks fell under blocking sanctions, their reserves were frozen, currency restrictions were imposed, and the banks were disconnected from SWIFT. What was the most unexpected and difficult challenge for you?

— We have been living under sanctions since 2014 and, therefore, have always considered the risk that the sanctions may increase. We did a lot of work in this respect and conducted stress tests with many financial institutions. Therefore, when the major banks fell under sanctions, they were largely prepared for it. Disconnection from SWIFT has been a threat since 2014, so we created our own national payment system. We diversified our reserves and increased the share of yuan and gold reserves. International payments were actually the biggest issue, and we are still working on it. Blocked and frozen individual assets are also a painful subject since millions of people who were not sanctioned ended up with frozen assets. We are still trying to solve this problem together with the government.

As for the frozen reserves, I think this is a highly negative signal for all the central banks, because it violates the basic principles of security. But in this regard, we were aided by the floating exchange rate and the currency restrictions, which we adopted last spring and which were quite severe. Later, as you remember, these restrictions were weakened. This helped us mitigate financial stability risks.

As you rightly mentioned, the financial sector was the first one to get hit by the sanctions – and there were a lot of sanctions, not just the ones you mentioned. But in general, we managed to maintain financial stability.

— Do you think that the sanctions pressure will increase, particularly in regard to the financial sector?

— It is impossible to predict the sanctions policy. But we calculate a scenario with increased sanctions pressure, and every year we present it in [the report called] ‘The Main Directions of Monetary Policy.’ There is definitely a certain risk. The main thing we can do to counter this risk is to ensure macroeconomic stability and financial stability. For example, we offered banks a wide range of easing measures but [now] began to roll these back. We believe that banks should again increase their capital buffers in case of possible shocks. These include not only sanctions but shocks related to financial conditions, and so on, which [the banks] must be able to withstand. Therefore, first of all, we need to understand the risks and be prepared.

— Politico magazine called you the “disruptor of the year” – among other things – for helping Russia adapt to the sanctions. Do you agree with this? And in your opinion, have we overcome all challenges? Are there any new shocks ahead?

— It’s hard for me to answer the first part of the question. I believe that the central bank has long pursued a policy aimed at protecting incomes from devaluation as a result of high inflation, and we will continue doing so. [We have also worked on] ensuring the stability of the financial sector, which would allow people and businesses to preserve their savings and provide financial resources for economic restructuring. We see that economic restructuring is happening quite quickly. This is primarily due to the market-based nature of our economy and the business [sector], which has adapted very quickly.

Of course, we may be tempted to think that we did so well in 2022, and now, as they say, we have weathered the storm. But we must be prepared for increased sanctions and pressure. We were able to respond to the main challenges, particularly in the financial sector, but even in that sector, there are still unresolved problems, including cross-border payments. Yes, [payment] chains are being constructed, and they are constantly changing, but [cross-border payments] remain a problem for many businesses. However, according to our surveys, this problem has become slightly less severe.

Trust in the financial market is still a challenge due to blocked assets, and because many issuers have closed [access to] information due to sanctions, and so on. For us, the challenge is long-term money in the economy, and not only long-term loans but the capital market as well.

The goal of developing the capital market is very serious. We will need to overcome a certain loss of confidence in the financial market due to the sanctions.

Another challenge is to maintain the same pace of development in the fields of innovation and technology. Our financial sector is quite advanced – many people now understand this, comparing [our system with that of] other countries in terms of payment methods and so on. To continue on this course of development, we need to develop innovations. Moreover, some solutions – not all, but some – used to rely on foreign [technological] developments. Now, we’re doing it on our own. And, by the way, we see how this affects the availability of IT specialists, programmers, and other experts in all fields.

Therefore, there will be certain issues, we cannot say that we have solved all the challenges. However, I have a rather positive outlook on the development of the financial sector and its stability. I believe it will remain technologically driven, innovative, and will be able to meet the needs of both individuals and businesses.

“Looking back, we see that the policy was soft”

— This year, around mid-summer, the central bank began raising rates. Looking back, would you say this measure should have been implemented earlier?

— There’s been a rise in inflationary pressure in the second half of the year. Currently, the price growth rate is really quite high, well above our inflation target. Yes, looking back, we see that the monetary policy was soft, and we should have raised the rate earlier.

— When?

— In the spring, for example.

— You said that the key rate will remain high until the Bank of Russia sees a fairly stable trend towards slower price growth and lower inflation expectations. What parameters will you rely on? Will a slowdown in inflation over a period of two to three months be enough to make a decision on easing the monetary policy?

— We will indeed have to make sure that inflation is on a stable decline and that these are not one-off factors that affect the rate of price growth in a particular month. That’s why we analyze a wide range of indicators – not only the general price growth index but particularly the indicators that characterize the stability of inflation. These include core inflation and the price growth rate without the consideration of volatile elements. [Also, we look at] the price growth rate on the goods and services that are less dependent on the ruble exchange rate. We will need to make sure that the decline in the stable [rather than one-off] price growth factors is in itself a stable trend.

This will take at least two or three months – it will depend on a wide range of indicators that characterize stable inflation. And, of course, inflation expectations are very important. These remain high and, according to recent polls, have further increased. High inflation expectations demonstrate inert inflationary processes. The higher the inflation expectations, the more difficult it is to reduce inflation. Therefore, we will consider all these factors.

— Just when things started slowing down and inflation expectations were about to decrease, egg [prices] had to surge and ruin everything.

— This is one of the parameters. When the price growth rate is high, something unexpected constantly happens. I remember in 2021, prices suddenly increased first on this product, then on that one. We may be tempted to associate high inflation with a specific product. But, unfortunately, there are general reasons [for the inflation]. First of all, this happens when a high growth in demand exceeds the supply.

— How long will the factors that boost inflation – such as high demand, record-high fiscal stimulus, and low unemployment – last?

— Some of these are long-term factors. This includes the situation in the labor market and low unemployment. But I believe this factor will actually determine supply [by influencing] the pace at which supply adjusts to the demand.

As for the fiscal stimulus, we indeed have a stimulating fiscal policy, but we expect that in 2024, it will decrease compared to 2023.

Consumer demand is indeed high, but it is directly influenced by our monetary policy and the key interest rate. There is a certain time lag between our decisions and their implementation in the economy. This is a long chain – after the key rate increases, the market rates on deposits and loans increase. This, in turn, affects the number of bank deposits and loans and influences people’s behavior – whether they will spend money, save it, and so on. And only after all of that does it affect prices. According to our estimates, the response lag is three to six [fiscal] quarters.

— It is still three to six quarters, so it isn’t getting longer?

— It’s still the same. We do not extend this period, but, of course, certain solutions may be implemented faster than others. It depends on other factors as well – inflation expectations, the dynamics of the exchange rate, and many other things. Therefore, in general, we assume that the decisions regarding the key rate are effective, we see that they are effective. They work, taking into account the response lags. We will assess how the effects of the previous decisions are being implemented in the economy.

— In September, you said that high interest rates in Russia will last for a long time. It seems that this has only fueled the demand for bank loans. Do you think that such a clear signal has, in a sense, played against the central bank?

— No, I don’t think so. Of course, there may be certain consequences, but they would have been indeed serious if inflation continued to rise and we increased the key rate very slowly. Then people would have realized that inflation is not about to slow down, that it would continue to increase, and the interest rate would continue to rise. But we tried to act decisively. Just to remind you, in six months, we have increased the interest rate from 7.5% to 16%. And each time, we assess whether the monetary policy is sufficiently rigid to achieve our inflation target of around 4% by next year.

The effects are already evident when it comes to market loans – for example, the demand for market-based mortgages is slowing down. Of course, certain demand is increasing – for example, the demand for subsidized mortgages: People try to quickly apply for such mortgages since when interest rates rise, the difference between a standard-rate mortgage and a fixed-rate subsidized mortgage makes it more attractive. But this actually relates to the scale of government subsidies more than to monetary policy.

“If oil prices reach $88-$90 per barrel, we can switch to buying foreign currency”

—In January, the central bank will resume the mirroring of fiscal rule-based regular operations by the Russian National Wealth Fund. The Bank of Russia remains a net seller of foreign currency, but will it also be a net buyer?

— Whether we will be a net seller or a net buyer largely depends on oil prices. If oil prices remain at their current level, we will be a net seller of foreign currency. If oil prices reach $88-$90 per barrel of Brent oil, then we can switch to buying foreign currency. In January, we will sell foreign currency. We will soon announce the operations that will happen in January.

— Do you consider it necessary to extend the presidential decree on the repatriation of foreign currency earnings, which expires in April 2024? You have always said that such measures should be temporary.

— I believe it should be a temporary measure. We indeed see that the amounts of foreign currency sold by exporters have been increasing. As of November, net sales of foreign currency by exporters came close to 100% of the revenue. But there are several factors [that we must take into account]. First of all, the currency is mainly sold by exporters, and this is driven by the high oil prices that we’ve seen in the past months.

Response lags exist here as well – between high oil prices, the arrival of export revenue, and the sale of currency. Mostly, the currency was sold due to high oil prices. There were [also] one-off factors related to foreign currency conversion for dividend payments. Plus, we’ve seen that some exporters, due to the high interest rate on ruble loans – which is also a result of our monetary policy — began taking foreign currency loans and then selling the currency to pay for their expenses in rubles. And, of course, the presidential decree also played a part. But it is probably impossible to isolate the effect of each particular factor now.

We believe the decree should be temporary because, over time, companies learn to circumvent the imposed restrictions. Plus, such restrictions make it difficult to make international payments, including payments for imports – such as the necessary equipment imports and so on. Therefore, we believe that [the decree] should be temporary. However, we will soon discuss this matter with the government.

— Is the sale of foreign currency revenue still a decisive factor for the ruble exchange rate?

I don’t believe so. The decisive, fundamental factors that affect the exchange rate include the state of the balance of payments, our exports, and the demand for imports in ruble terms. This demand has been fueled by the availability and rapid growth of ruble loans, among other things. So presently, the monetary policy clearly affects the stabilization of the exchange rate.

— So, in March, when the decree expires, we will not see any drastic changes in the situation on the foreign exchange market?

— We don’t expect that to happen.

— You mentioned the challenges for businesses [that may arise because of the decree]. There is something called “ruble circulation” – i.e. exporters who receive revenue in rubles under the terms of their contract need to convert it into foreign currency, return it, and convert it once again. Do you see the risks of such a double conversion?

— There is a certain problem related to the fact that many companies have switched to receiving export revenue in rubles. Though generally, this is a positive [trend]. When they are forced to convert a part of their revenue into foreign currency in order to sell it later, this increases the turnover of the foreign exchange market, but for companies, it simply implies additional commission fees for converting the currency. This has no major impact on the exchange rate.

— It has a greater impact on business.

— On business, yes. In terms of certain additional fees.

— Will there be any adjustments to the decree in this regard?

— This will be decided by the government.

“Banks will continue to make a profit”

— This year, we expect a record net profit for the banking sector. This has partly been a result of the currency revaluation, but that was a one-off factor. Are there any fundamental reasons why this year was so successful for the banks, or was it just luck, and next year could be much worse?

— Most of the reasons behind the profit growth are fundamental ones, although there were also certain one-off factors, such as the currency revaluation. In 11 months, banks earned a profit of 3.2 trillion rubles, including about 500 billion rubles, as a result of the currency revaluation. I’ll remind you that last year, they lost one trillion rubles due to the currency revaluation. But of course, the fundamental factors have been more important.

One of them – and it came as a surprise to many people – was how quickly the economy adapted to the sanctions and how quickly it has grown. Of course, this means better business for banks. Look at the figures for yourself: As of the beginning of December, corporate lending increased by 21% year-on-year, mortgages increased by 35%, consumer lending grew by 16%, and the commission incomes of banks increased by 38%. All this shows the development of the economy and the development of business.

But when we estimate the profits of the banking system, it is very important to look at the total two-year profit. Last year, bank profits amounted to just 200 billion rubles, they decreased almost ten times. In the economy as a whole, profits decreased by about 10%. Why did this happen? Because the banks acted in a conservative manner – and they were right to do so. They created reserves, expecting that some of the loans they provided would cease to be serviced since many businesses could get into financial trouble. But since the economy has been growing and loans are being serviced, the banks judge borrowers to be solvent, and they have dissolved these reserves this year.

But when we consider two-year profits, the average profits will probably be 1.7–1.8 trillion rubles. This is about a quarter less than in the ‘normal year’ of 2021.

Profits will remain positive next year, even without taking one-off factors into account. And this will allow banks to increase their capital. The banks have practically no other sources [of capital] – there is no access to external sources, so profits are their main source of capital. And capital is necessary in order to provide loans to economic sectors – without it, it is impossible to increase [the number of] loans. Therefore, banks will remain profitable and will continue to provide loans.

— Even at the current interest rates?

— Yes, even at the current rates. We’ve seen that lending has slightly slowed down as a result of high interest rates. I have already mentioned [the decrease in] mortgages and unsecured consumer lending. The first signs of this appeared in corporate lending. However, due to high inflation expectations, people and businesses took more loans because they believed that inflation would remain high. Therefore, inflation expectations are very important to us, and we are monitoring them. We expect that next year, lending growth won’t be as high as this year, but it will remain positive. In general, it will be about 5-10%.

— Large banks are planning to provide a fewer number of unsecured loans and mortgages in 2024. How will this affect their profits in 2024? Will the average profits that you mentioned – 1.7-1.8 trillion rubles – be exceeded?

— So far, we expect that the profit of the banking sector next year will be slightly over two trillion rubles. Due to high rates, the margin may slightly decrease, particularly since high interest rates are passed through to deposits more quickly than to borrowers and lenders. But nevertheless, economic activity is developing, there are positive growth rates, and [the banks] will earn profit.

“Subsidized mortgages will not be a rarity”

— The conditions for providing subsidized mortgages have already been made more strict. Could such mortgages become a rarity next year? Or perhaps all mortgages will become rare, considering the current interest rates?

— No, of course, mortgages will continue to be in demand. According to our estimates, this will not be a 35% growth, as this year, but around 7-12%. On the positive side, as a result of the decrease in the number of loans, real estate prices won’t grow as much. Because housing prices have also significantly increased.

Subsidized mortgages will not become a rarity. We assume that the large-scale subsidized mortgage program will end in July, but, for example, the Family Mortgage program will remain effective. This is a very popular type of mortgage. Family mortgages are now about the same in size as general subsidized mortgages. Therefore, subsidized mortgages will remain and, of course, will not be as “exotic” as they were before 2020. Moreover, market-based mortgage [programs] will develop. This process has slowed down a bit, but market-based mortgages continue to develop.

— The government has already agreed to increase the size of down payments and reduce the loan amounts on subsidized mortgages for the residents of the country’s main regions. Is the idea of differentiating mortgage rates by region, which was proposed a while ago, still relevant? If so, how much can we expect mortgage rates in Moscow and St. Petersburg to rise?

— Yes, we are discussing regional mortgage programs. A special working group has been set up in the State Duma, and we are a part of it. The Family Mortgage program is likely to remain. We will soon talk about extending it and the possible requirements. Family Mortgages are part of targeted mortgage programs.

There are indeed challenges since, in a number of regions, the housing market is stagnating. We see that the construction of new housing and affordable mortgages are mostly available in large cities. But we must give people a chance to solve their housing problems regardless of where they live. We will discuss how this may be done.

And, of course, we will also need to leave room for market-based mortgages. After all, people who do not fall under any preferential category or targeted social support program should be able to solve their housing problems with the help of market-based instruments.

— Could you list any regions that may take part in the subsidized regional mortgage program? What mortgage rates could be acceptable for them?

— It’s too early to answer both questions. Probably, it would not even be correct to consider a certain region as such. Because often, in the region’s major cities, the situation is acceptable, while in medium-sized cities or small towns, there are major problems.

I believe that we need to consider this subject in more detail, but all this requires discussion. The management of these programs and the criteria are very difficult issues. We have a working group – I think it will discuss all these possibilities. But, once again, the Family Mortgage program will most likely remain the basic [subsidized mortgage program], while the regional mortgage program requires additional discussions.

— The Bank of Russia pointed out the current imbalance in the mortgage market – prices on new housing (first-sale units) are a lot higher than on existing housing (resale). This fall, the gap exceeded 40%.

– Yes, it was 42%.

— What are your expectations after the forthcoming changes in the terms of the subsidized programs next year? Will this gap shrink, and if so, to what extent and how fast?

— I believe the gap should shrink. Because it carries risks for people and for banks. Before the introduction of large-scale subsidized programs, the gap was about 10%.

In the next few years, we should go back to the normal pricing gap between the new housing market and the existing housing market. How quickly this will happen will depend, among other things, on the subsidized programs – whether they will cover only first-sale housing or resale housing too. In my opinion, these programs should solve the challenges of people, providing them with affordable housing, rather than just supporting developers. If people improve their living conditions, it doesn’t matter whether they buy a new or resale property. But this also must be discussed with the government since the government is responsible for the subsidies. But I believe the gap should at least stop growing, because it kept growing last year as well, so it should begin to slowly shrink. But now, it is probably too early to talk about the pace at which [this gap] will shrink.

“Are there any issues that haven’t come to light yet? Probably, there are.”

— For the first time in many years, the central bank has not revoked a single banking license in the course of the year. For anyone who follows the financial market, this is a very unusual situation. How did it happen? Are our banks so resilient or…

— They are resilient.

— Or maybe some of the challenges haven’t come to light yet, after the shocks of last year? What do you think?

— The sanctions crisis that we experienced last year and this year was a test that demonstrated the effectiveness of our policy. And I can confidently say that the banks are indeed resilient – they coped with so many problems and survived this period well.

Are there any issues that haven’t come to light yet? Yes, probably there are, but these are not major problems. They include the blocked assets of banks. We have implemented easing measures so that [the banks] can create reserves within a period of ten years. When it comes to other regulatory concessions, we are gradually rolling them back. We are returning to normal regulation and to creating additional buffers.

— So 2024 may also pass without any revoked licenses?

—I hope so.

— Unexpectedly for the market, Vladimir Komlev – the head of the Russian National Card Payment System (NSPK) – recently announced that he would be leaving his post on January 1, after ten years in office. Could these changes indicate that the central bank intends to change the NSPK’s course of development?

— No, the course of development will remain the same: The creation of a national payment infrastructure. This has always been the goal of the NSPK and will remain so. The development of this infrastructure, which can be used by all the players in the financial market, ensures [healthy] competition. Both the central bank and NSPK will continue to pursue the same path.

And, of course, I would like to thank Vladimir Valeryevich [Komlev] – he has done a lot to provide Russia with its own national payment system – the Mir bank card and the Faster Payments System. Because when we started these projects in 2014, I remember how much skepticism there was. [People said], “Who needs this? We have Visa, we have Mastercard, we have other payment systems.” But we see that it turned out to be profitable. And these services, including the Faster Payments System, allow different banks to compete in the payments market.

“There are risks of investing in foreign securities even through friendly countries”

— The St. Petersburg (SPB) Stock Exchange was included in the Specially Designated Nationals (SDN) list. The regulator was reproached for allowing private investors to buy foreign securities, although unqualified investors were restricted from doing so. Where can we draw the line between protecting the interests of individual investors and offering a wide range of tools on the [financial] market?

— Finding balance is really difficult. We should give people an opportunity to diversify investments, but at the same time, protect them from risks that they may not be able to understand. We focus on protecting the unqualified investor. Indeed, our people had the opportunity to invest in foreign securities so that they could diversify their investment portfolios. And if they hadn’t had a chance to do this through Russian infrastructure, many would have done it directly through Western infrastructure.

After the sanctions were imposed, we warned about the [infrastructure-related] risks and restricted unqualified investors from buying foreign securities.

By February of last year, our investors owned almost $7 billion worth of foreign securities. As of November of this year, that number decreased to just over $3 billion. So, over this time, people have significantly reduced investments in foreign securities. And now, over 80% of holders of foreign securities are qualified investors.

Of course, there are risks of investing in foreign securities even through the infrastructure of friendly countries. We warned about these risks and obliged brokers to inform their clients. It’s one thing to work in a Russian jurisdiction, but it’s another thing to be responsible for the risks of a foreign jurisdiction. We see that our concerns were not in vain because many investors who owned foreign securities through the infrastructure of friendly countries met with challenges. Due to the risk of secondary sanctions, these organizations are now conducting lengthy compliance procedures.

— What does the central bank think about the fate and future prospects of the St. Petersburg Stock Exchange?

— Many of our large financial institutions are under sanctions. You can see for yourself that almost all of them have adapted, changed their business models, and continue to develop. I am sure that the St. Petersburg Stock Exchange will not be an exception. It is already considering new services and new products, and it possesses a high-tech infrastructure and is professionally competent. Therefore, I don’t feel worried about it.

— You mentioned that the Bank of Russia is considering scenarios of more severe sanctions. Do you consider it probable that sanctions will be imposed against the Moscow Stock Exchange? And in such a case, which currency trading scenarios will be implemented to determine the exchange rate?

— We consider different scenarios and different options of how to act [in such a case]. And so does the Moscow Stock Exchange. As for the functioning of the foreign exchange market, we also have an off-exchange market that offers currency trading. By the way, it already accounts for more than half (53%) of currency trading. As for the exchange rate mechanism, assessing various sanctions risks, last year, we issued an instruction explaining how the exchange rate would be determined. It will be established on the basis of off-exchange trading data, including bank reporting.

— In the absence of exchange trading, can off-exchange trading rates spin out of control?

— No, I don’t believe there will be [such risks]. It depends on the supply and demand [of the currency]. We have a fairly large off-exchange trading volume, and there are many players. However, we will need to obtain information about off-exchange transactions, so we will make use of different sources. But I don’t think that this in itself can seriously affect the exchange rate.

“There is interest, but it is weighed against the fears of sanctions”

— How do you assess the possibilities of an exchange of blocked assets between private investors? Are you aware of cases when non-residents asked national regulators for permission to carry out such operations?

— We have created the legal conditions that are necessary for such an exchange to take place. We believe this can be mutually beneficial for investors. But then, everything depends on the investors themselves, and primarily the non-residents. Currently, I have no information on whether they requested such [permission] or not.

— If everything works out and this stage of the exchange process takes place, will there be other steps? And will you increase the maximum amount that may be exchanged?

— Let’s first see if it happens, and then we will talk about it further. Because this stage is very important. It is aimed at helping a large number of investors, those with small investment amounts.

— The central bank discussed plans to build new chains with friendly depositories in order to gain access to foreign markets – but clearly, only friendly foreign markets. How are these plans going? And what kind of depositories are these?

— Indeed, building depository bridges is very important. We see that there is a need for this. We are holding talks with regulators of friendly countries to ensure that such projects are implemented. By the way, in September, we adopted a decision made by the board of directors and removed some regulatory barriers to constructing such bridges. If necessary, we are ready to make further adjustments. We see that the market players are also strengthening their cooperation. But so far, it’s too early to talk about final decisions. [The matter] is currently at the stage of discussions and [of seeking different] approaches.

— Can you specify what kind of friendly depositories these are? Are they in neighboring or far-away friendly countries?

— [We’re talking about] all friendly depositories.

— Do you feel that the other side is interested in this?

— There is interest, but it is weighed against the fears of secondary sanctions.

“There is always a chance that some people will engage in unfair practices”

— The president recently proposed extending the insurance of funds so that it would cover investment accounts up to 1.4 million rubles. However, this insurance will cover only the risks associated with the broker’s bankruptcy, not market risks. Do you have any concerns that unfair practices may arise since market players may tell clients that everything is insured, so they should “invest boldly”?

— Yes, we have such concerns. Because there is always a chance that some people will engage in unfair practices. We have already seen this. Particularly in cases when investment products were sold under the guise of insurance or capital guarantees. This happened even before this type of insurance existed. But we will fight against it. We will clarify [the situation] and put an end to these practices.

— Speaking of new tools for attracting long-term money, long-term investment tools, individual investment accounts of the third type (IIA-3), and long-term savings programs – how relevant are these tools for the investor, and will they be in demand?

— We believe they will be in demand. We see this based on the experience with IIA-1 and IIA-2 [brokerage accounts]– although a major motivation [for getting] IIS-1 was related to obtaining tax benefits. But we believe that people will also show interest in these [new tools]. We need to talk about these tools more. But we see people’s interest in investment diversification and even extending the investment [period]. Moreover, we also provide a number of benefits.

This interview was first published by RBK, translated and edited by the RT team:

https://www.rbc.ru/interview/finances/2 ... m=column_2

https://natyliesbaldwin.com/2024/01/rt- ... -the-west/

********

Russian Asset Seizure Scheming: EU and Euro as US War Proxies Would Take Most Risk; USD Assets Only $4.6 Billion

Posted on January 4, 2024 by Yves Smith

It is disappointing to see anti-globalist commentators who normally give astute commentary distort a story by force-fitting it into their existing framework, here the decline of the dollar. The widely-told tale, based on a Financial Times story, is that a paper by US officials to try to build G-7 consensus on appropriating the $300 billion of Russian central bank assets frozen in Western countries participating in the sanctions would be devastating to the dollar if its ideas were implemented. In fact, as the very same article showed, these assets are overwhelmingly Euro assets, in the hands of European depositaries and banks.

Moreover, the pink paper made clear that EU finance officials and bankers, particularly in France and Germany, which have big exposures, are leery of this type of US adventurism. And it’s not as if every US idea for aggression against Russia gets done, such as the $60 billon of spending stalled in the House.1 Recall the flop of a NATO summit last summer at Ramstein, where there was much discussion in advance of increased commitments to Project Ukraine. In light of that, it’s not hard to see the latest US ploy as an effort to change the topic from “And what happened to all the reconstruction funds you promises?” Remember that Penny Pritzker is in charge of the initiative to round up investor monies to rebuild Ukraine, with BlackRock in a leading role.2 On her last trip to Kiev, she effectively told Ukraine not to expect much from the US. From Ukrainska Pravda in November:

Penny Pritzker, US Special Representative for Ukraine’s Recovery, has suggested that officials imagine how the country could survive economically without US aid during her first visit to Ukraine….

Ukrainska Pravda stated that her first visit to Ukraine had left “a rather disturbing aftertaste in many government offices” here.

One of the sources, familiar with the course of Pritzker’s meetings, said that she tried to “lead [them] to the idea” of how Ukraine could survive economically without American aid.

Quote from the source: “At the meetings, Penny tried to get people to think, like, let’s imagine that there is no American aid: what do you need to do over the next year to make sure that your economy can survive even in this situation? And it really stressed everyone out.”

Now to turn to December 20 Financial Times article, The legal case for seizing Russia’s assets, which I confess to not reading at the time due other distractions and assuming it was accurately reported elsewhere, so there was no point in my weighing in late. Ooopsie!

One issue commentators stomped on, correctly, was the absurd pretext for an asset grab, that these would amount to reparations. But reparations, in the context of war, are paid by losers for the damage done. This war is not over (so in legal terms, the matter is not ripe). And more important, does anyone think Russia will lose, absent a black swan event or not credible redefining of terms? The Financial Times describes the latest attempt at a justification was a “countermeasure”. But again, the direct precedent suggested was “compensation” after Iraq invaded Kuwait…and then the US subjugated Iraq in Project Desert Storm.

But as for who would be most likely to be severely damaged with this sort of plundering, it’s the EU and Euro due to them accounting for the vast majority of exposures. Yes, Russia would probably make sure the US also suffered consequences, particularly given its role as presumed instigator, although Ursuala von der Leyen has made “Seize, not freeze” part of her brand. But it is European institutions who control the vast majority of the holdings, and they can’t pretend not to be independent actors (it’s not as if the EU depends on the US financially, as it does militarily with NATO). From the Financial Times:

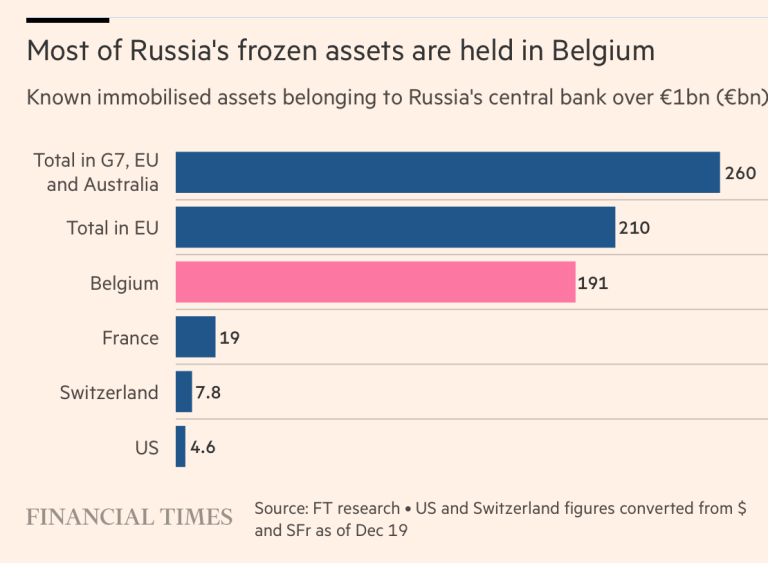

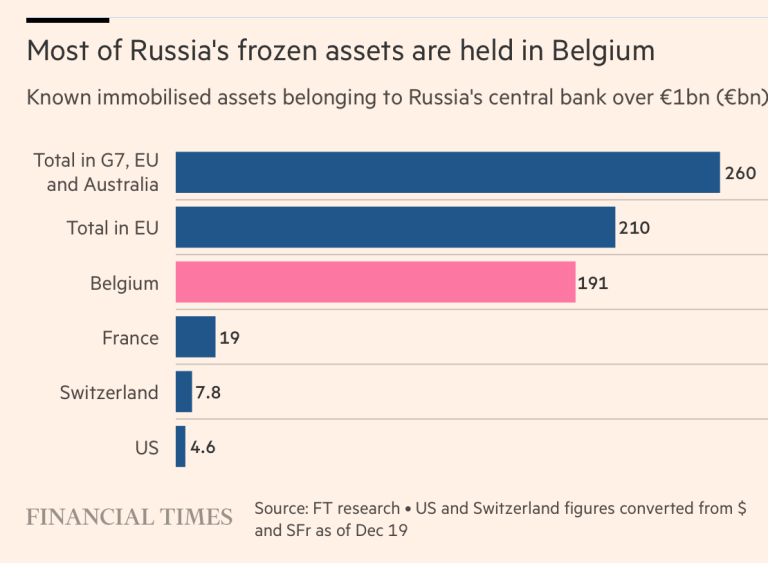

About €260bn of Moscow’s central bank assets were immobilised last year in G7 countries, the EU and Australia, according to a European Commission document seen by the Financial Times.

The bulk of this — some €210bn — is held in the EU, including cash and government bonds denominated in euro, dollar and other currencies. The US by comparison has only frozen a small amount of Russian state assets: some $5bn, according to people briefed on the G7 talks.

Within Europe, the bulk of the assets — about €191bn — are held at Euroclear, a central securities depository headquartered in Belgium. France has immobilised the second-largest amount, some €19bn, according to the French finance ministry. Other holdings are far smaller, with Germany holding about €210mn, according to people briefed on the figures.

A December Reuters story paints a similar picture, but is based on start of 2022 figures from the Russian central bank. The disparity between the total in dollars versus the total held in the US is likely due to the Russian central bank holding dollar balances in non-G7 central banks, such as Switzerland. From Reuters:

At that time, Russia’s central bank held around $207 billion in euro assets, $67 billion in U.S. dollar assets and $37 billion in British pound assets.

It also had holdings comprising $36 billion of Japanese yen, $19 billion in Canadian dollars, $6 billion in Australian dollars and $1.8 billion in Singapore dollars. Its Swiss franc holdings were about $1 billion.

So oddly, the Financial Times (presumably following the US concept paper) did not cite the British pound assets, which at least at the start of 2022, were bigger than the amount of dollar assets supposedly held by the US. So if this is directionally correct (UK banks now hold more in Russian frozen assets than US banks too), the UK is also volunteering to go ahead of the US in the “shoot yourself” line.

Note the Reuters story mentions Swiss Franc holdings of $1 billion equivalent; the Financial Times chart, which admits to being “known” as in potentially incomplete, shows a Swiss total of %7.8 billion. That means at least $6.8 billion in non-Suisse assets. It is conceivable that the Swiss dollar holdings are as large as the dollar holdings in US banks.

So where might the other dollars be? Recall there was a brief flurry of reporting a way back that (mumble, shuffle) the Western power actually could find only part of the $300 billionish that they’d frozen. That talk stopped and the story reverted to the notion that the Western powers indeed had $300 billion, as in how they’d supposedly lost and then miraculously found the missing assets was never explained.

Recall also that when the sanctions were impose, the rouble tanked to about 120 to the dollar. The Russian central bank engaged in stabilizing transactions to push it up. How could the central bank have done that, as in sold dollars to buy roubles if its assets were frozen? Presuambly nearly all its dollar assets were in institutions participating in the sanctions. This suggests, as we said at the time. that in fact the money was not all properly locked up when the sanctions announced and Russia was able to access, as in sell or move, a part of it. That could apply just as well to that at least once $37 billion worth of sterling assets, that Russia was able to extract some because the sanctions weren’t applied as hard and fast as they were supposed to have been.

The Financial Times article cites legal experts who point out that plenty of countries have grievances with others, and “countermeasures” are generally used to try to change behavior, not impose damages. Further, as most people know or intuit, bank assets, particularly central bank assets, are perceived to be in safe custody when placed with a foreign depositary. Recall the consternation in the US when Wells Fargo was caught out pilfering from depositor accounts. Even though the stealing was nickel and dime level across many many accounts, the press official reaction was fury. This is the same principle, just on a different scale.

Now it is true that the US making off even with a mere $4.6 billion of Russian holdings would such a bad precedent that it could make many investors leery of holding dollar assets. But again, it is EU states that would be putting themselves on the firing line. Again from the Financial Times:

The ECB earlier this year warned member states of the risk of undermining the “legal and economic foundations” on which the international role of the euro rests. “The implications could be substantial,” it said, according to an internal EU note. It warned the bloc of the risks of acting alone and recommended for any action to be taken as part of a broad international coalition.

One EU diplomat said: “Every major euro-denominated economy is treading very carefully on this because of the potential effects for the euro and for foreign investment and clearing in euro.”…

Officials are aiming for a consensus among G7 countries to seize the assets, but France, Germany and Italy remain extremely cautious.

European officials fear possible retaliation if state immunity is undermined. One noted the US holds only a very small amount of Russian central bank assets by comparison. “From an EU perspective we have much more to lose,” the EU official said.

The late December Reuters article suggests Russia has the means to retaliate directly:

Some Russian officials have suggested that if Russian assets are confiscated then foreign investors’ assets stuck in special so-called type “C” accounts in Russia could face the same fate. Some foreign assets were effectively locked in the C accounts.

It is not clear exactly how much money is in these accounts but Russian officials have said it is comparable to the $300 billion of Russian reserves frozen.

Finance Minister Anton Siluanov said last week that there were significant funds on the C accounts.

Kremlin spokesman Dmitry Peskov told reporters last week that Russia would challenge any confiscation in the courts.

“If something is confiscated from us, we will look at what we will confiscate,” Peskov said. “We will do this immediately.”

Given that some recent bright US ideas, such as Operation Prosperity Guardian, quickly became an embarrassment, says that US incompetence and over-reach have suddenly become glaringly obvious to its allies. That plus US loss of moral stature over its refusal to check Israel’s slaughter of Palestinians should help give Europeans the needed backbone to resist being put in financial harm’s way to damage Russia…even before getting to the wee complication that the last big effort to harm Russia economically boomeranged.

One lost big ticket proxy war should be enough of a lesson for Europe. Perhaps Europeans have a saying like the Yankee staple, “Fool me once, shame on thee, fool me twice, shame on me.”

___

1 The irony here is the spending in that bill is largely to replenish weapons sent to Ukraine, as in it is really a direct transfer to the military-surveillance complex. But Ukraine has become so toxic in some circles that even an arms pork bill dressed up as a Ukraine spending bill can’t get done. The flip side is with the Middle East hotting up and China still very much an object of US negative affection, it’s not as if defense contractors have to worry where their meal ticket is coming from.

2 Why BlackRock is beyond me, since BlackRock runs funds that overwhelmingly invest in liquid securities; it isn’t in the top 10 of infrastructure investors, which would be the germane market, and its position fell in 2023 versus 2022.

https://www.nakedcapitalism.com/2024/01 ... llion.html

*******

Latvia is ready for deportations: why Ukrainians should not relax

January 4, 2024

Rybar

Since the start of the Special Military Operation on the so-called. In Ukraine, many post-Soviet republics took advantage of the opportunity to begin, continue, and in some places finally resolve the so-called “national question.”

Somewhere this was expressed in attacks by individual groups or individuals on the Russian-speaking population, in getting rid of names and associations with a common past, in direct or indirect assistance to political opponents of Russia. However, in the Baltic countries, persecution based on nationality has been approved both at the country level and in individual entities. This is especially clearly seen in the example of Latvia, where the Russian-speaking population was larger than in the other two Baltic republics, and remains to date due to the Ukrainian refugees who arrived there.

Here it all started, as usual, with the expulsion of the Russian language from schools and cultural institutions, with the banning of memorial ceremonies in honor of May 9 and the persecution of individual political activists and journalists. But, as practice has shown, all this was just preparation for much larger events.

Announcement of deportations

In December 2023, the Latvian Office of Citizenship and Migration Affairs announced that more than a thousand Russian citizens living in Latvia could be subject to preliminary expulsion.

According to official data from the department, about 15.5 thousand Russian citizens applied for permanent residence permits, and almost three thousand for temporary residence permits.

At the same time, more than 2,200 people by November 30, 2023 had not fulfilled the legal requirements allowing them to remain living in Latvia. The migration department also added that “they see that there are many who were late, tried to sort everything out, apply for temporary residence,” but, “unfortunately, we have to tell such people to leave.”

At the same time, the Latvian authorities avoid giving clear figures - and this is understandable, because such manipulations leave a lot of room for maneuver. For example, to expand or reduce the circle of people who could potentially be subject to violation of migration laws, and subsequently to deportation.

Specific measures

At the same time, the mechanism for deportation is already ready - in December 2023, the Seimas adopted a bill amending the national “Police Law” and granting law enforcement officers new powers.

In particular, Latvian citizens may now be denied leaving the country without trial - for at least four months. The basis in this case may be a “potential threat” to a given citizen, although it is planned to assess the nature of this threat solely at the discretion of the police.

You can challenge such a decision, but this will not stop the travel ban. However, it is not so difficult to imagine the potential “addressees” of this measure - pro-Russian journalists, activists, as well as citizens with close ties to family in Russia or Belarus. It is the latter, by the way, due to the lack of possibility of normal travel to Russia, that all of the above prefer to leave. Including for the purpose of salvation from political persecution.

Additionally, the police were able to detain any person who may be subject to deportation according to local laws . That is, potentially we are talking not only about violators of Latvian migration legislation, but also about any person who “grossly” violated local orders.

To make it easier to exercise such a right, law enforcement officers will also now be able to use physical force, special equipment, transport, use service dogs and horses, place detainees in temporary detention centers and even separate groups of people in these centers if necessary - that is, in essence, separate families.

At the same time, it is possible to obtain grounds for restricting the right to leave – or, conversely, for detention for the purpose of deportation – on the basis of statements and certain evidence that are not supported by any court decisions.

In this case, the participation of a judge is still implied - but for the purpose of issuing a ban on deportation. As you might guess, getting it will be much more difficult, but for a certain circle of people who demonstrate loyalty to official Riga, it is quite possible.

Narratives and situation

At the same time, certain narratives are spreading on the territory of Latvia, as well as other Baltic states, leveling the negative effects of what in any country outside the European Union would be called “ethnic cleansing.”

Moreover, the narratives are not as radical as, for example, those that are spreading in Ukraine and provoking direct violence against the Russian-speaking population. In Latvia, everything is somewhat thinner and is on a different plane.

For example, citizens celebrating May 9 were often associated with those who in smoking rooms are referred to only as “gopniks.” Stories about excessive libations during the festivities, hooliganism, drunken and noisy driving with Russian and Soviet flags, mountains of garbage in the forested area after the May weekend were promoted. In contrast, they presented calm and quiet trips into nature for Latvian families with children, where everyone behaved quietly and decently.

Along the way, in the rhetoric of officials at various levels, theses about the “Soviet occupation” and the history of a certain “liberation struggle” that the Latvian people allegedly waged from time immemorial and were forced to suffer began to be replicated again . This is provided that until the beginning of the 20th century there was never any talk about any personal statehood of the Baltic tribes - with the exception, perhaps, of the Lithuanians, and even then with the reservation of the help of the German and Polish “occupiers”.

The occupation theses previously laid the foundation for the elimination of the Soviet legacy, but now everything is reaching a new level associated with the persecution of the entire Russian-speaking culture. This includes the ban on New Year's events using Russian songs, the invitation of Father Frost and the Snow Maiden, the elimination of Russian-language repertoire in key national theaters, and the destruction of the monument to Alexander Pushkin (which turned out to be a symbol of “Russian imperialism”).

In the future, it is planned to go even further: to eliminate street names, as well as remove monuments associated with Latvians supporting Soviet or Russian rule . That is, people's poets of the Latvian SSR (for example, Jan Rainis or Imants Ziedonis), writers and politicians (Vilis Lacis), artists (Aivars Gulbis) and many others.

All of the above has already led to the emergence of a specific practice: young ethnic Russians, as well as children from mixed families, deliberately choose to indicate Latvian nationality in their passport data, fearing reprisals and problems when applying for jobs and universities - provided that, in addition to Russians, in these territories Also historically there are Germans, Jews, mixed Baltic families speaking Russian, Belarusians, as well as Ukrainians.

The last two categories will also not be able to live in peace in this situation. Citizens of Belarus, as well as ethnic Belarusians, of whom there are plenty in the local border area, are already equated with Russians and suffer similar inconveniences. As for Ukrainian refugees, the temporary calm and cooperation of official Riga with the Kyiv regime does not serve as a guarantee of security for them. Initially, anti-Russian narratives were eagerly applied to Ukrainians living in Latvia, who, from the point of view of the nationalist-minded Riga government, are no different from ordinary Russians and are subject to assimilation. However, another option may work here.

In the twentieth of December, the authorities of another Baltic country - Estonia - announced that they could start searching for and issuing the so-called. Ukraine of Ukrainians of mobilization age located in the Estonian state. We do not exclude the possibility that Riga and Vilnius will join Tallinn on this issue, thus carrying out the deportation of this layer of Russian-speaking (after all, Ukrainian refugees speak Russian), but not at all pro-Russian population. The amendments to the legislation, which we wrote about above, fully allow this, and the concept itself is fully consistent with the plans of Western curators, who have significantly reduced the population of the Eastern Slavs over the past year.

https://rybar.ru/v-latvii-gotovy-k-depo ... ablyatsya/

Google Translator